In 2025, Xe Money Transfer remains a popular choice for international money transfers. This review explores its features, benefits, and what users can expect.

Xe Money Transfer has been a trusted name for over 30 years. It provides real-time exchange rates and secure transfers to more than 190 countries. Whether you’re sending money to family or managing business payments, Xe offers a range of services tailored to your needs.

With low fees, live tracking, and a user-friendly mobile app, Xe continues to be a reliable option for global money transfers. In this review, we will delve deeper into what makes Xe Money Transfer a top choice in 2025. Stay tuned to learn more about its features and user experiences.

Introduction To Xe Money Transfer

Welcome to our detailed review of Xe Money Transfer for 2025. Xe Money Transfer is a global leader in currency conversion and international money transfers. With over 30 years of experience, Xe offers a reliable and secure platform for transferring money to over 190 countries. This section will introduce you to Xe Money Transfer and its key features.

Overview Of Xe Money Transfer

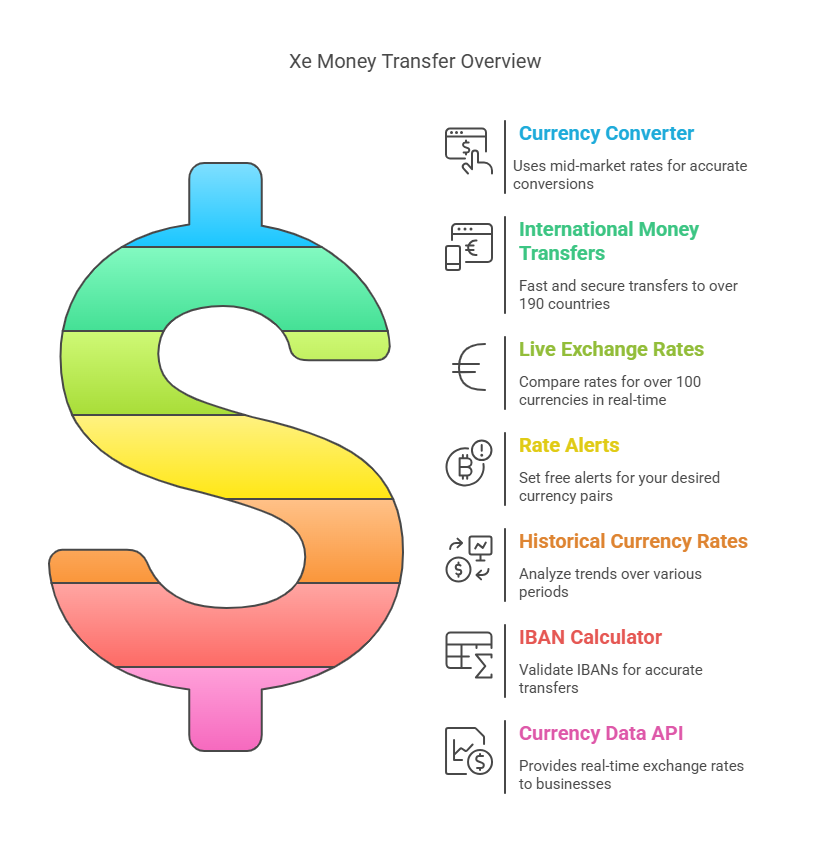

Xe Money Transfer provides an all-in-one solution for currency conversion and international money transfers. It offers real-time exchange rates, ensuring you get the best possible rates. Here are some of the main features:

- Currency Converter: Uses mid-market rates for accurate conversions.

- International Money Transfers: Fast and secure transfers to over 190 countries.

- Live Exchange Rates: Compare rates for over 100 currencies in real-time.

- Rate Alerts: Set free alerts for your desired currency pairs.

- Historical Currency Rates: Analyze trends over various periods.

- IBAN Calculator: Validate IBANs for accurate transfers.

- Currency Data API: Provides real-time exchange rates to businesses.

Purpose And Use Cases

Xe Money Transfer serves multiple purposes, making it a versatile tool for both individuals and businesses. Here are some common use cases:

- Personal Transfers: Send money to family and friends abroad.

- Business Transactions: Manage international payments and mitigate FX risks.

- Travel Expenses: Convert currency for travel needs.

- Online Shopping: Pay for international purchases.

Xe offers a convenient and secure platform for these transactions, ensuring your money reaches its destination quickly and safely.

| Feature | Details |

|---|---|

| Transfer Fees | Low fees starting at $0, depending on the transfer amount and destination. |

| Security | Verifies identity to keep your money safe. |

| Mobile App | Manage currencies and transfers on the go. |

| Support | Available via live chat, phone, and email. |

With its user-friendly interface and robust features, Xe Money Transfer is a trusted choice for millions globally.

Key Features Of Xe Money Transfer

Xe Money Transfer offers a range of features that make it a popular choice for international money transfers. With over 30 years of experience, Xe has established itself as a trusted platform for currency conversions and global money transfers. Here, we discuss some key features that set Xe Money Transfer apart.

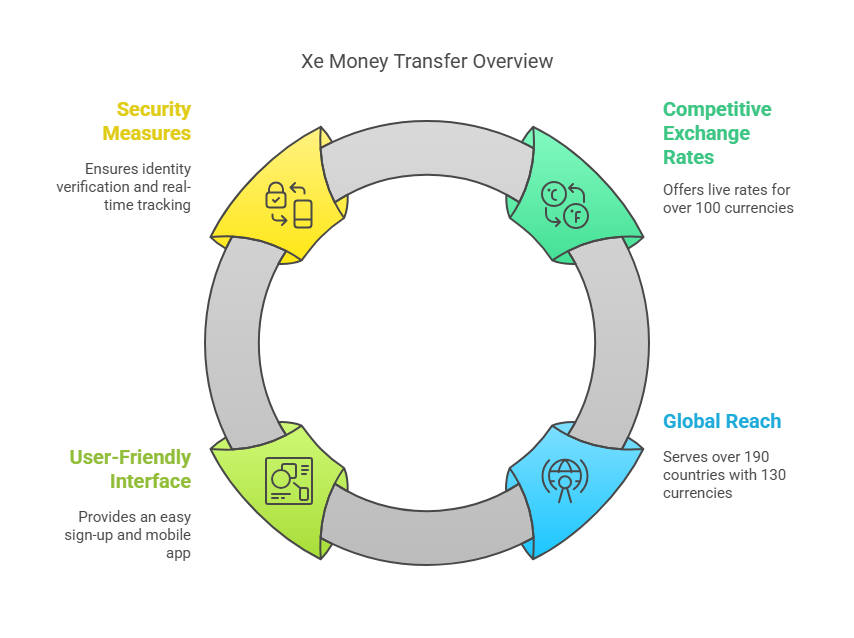

One of the standout features of Xe Money Transfer is its competitive exchange rates. Xe provides live exchange rates for over 100 currencies, ensuring users get the best possible rates. The platform uses the mid-market rate for currency conversions, which is considered the most accurate and fair rate available.

- Real-time exchange rates

- Comparison of rates for over 100 currencies

- Rate alerts for desired currency pairs

Xe Money Transfer boasts an extensive global reach, offering services to over 190 countries. This wide coverage makes it a convenient choice for users who need to send money internationally. Whether you are transferring funds to Europe, Asia, Africa, or the Americas, Xe has got you covered.

| Feature | Details |

|---|---|

| Supported Countries | Over 190 countries |

| Supported Currencies | 130 currencies |

The user-friendly interface of Xe Money Transfer makes it easy for users to navigate and complete transactions. The platform offers a seamless sign-up process and straightforward steps for transferring money. With the Xe mobile app, users can manage their transfers on the go.

- Easy sign-up process

- Intuitive navigation

- Mobile app for Android and iOS

Xe Money Transfer prioritizes the security of its users. The platform uses advanced security measures to verify identities and protect money transfers. Users can track their transfers in real-time and receive support via live chat, phone, and email if needed.

- Identity verification

- Real-time transfer tracking

- Support via live chat, phone, and email

Competitive Exchange Rates

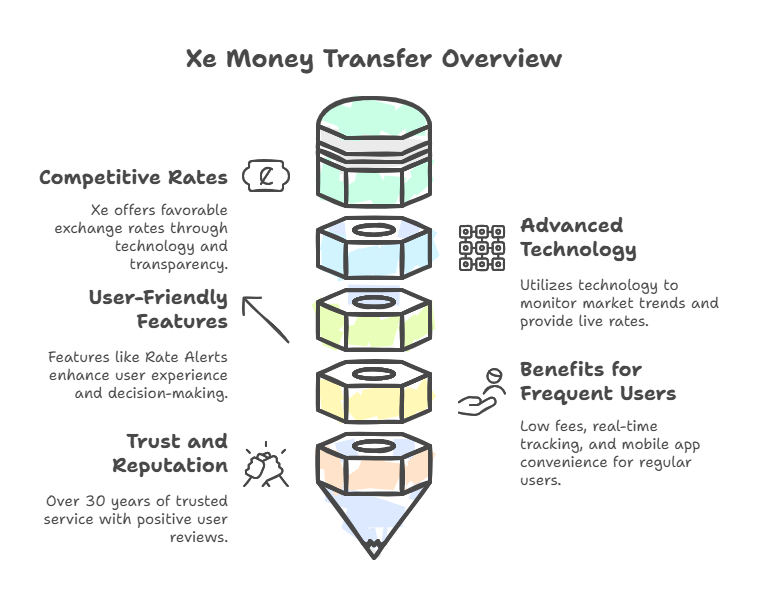

Xe Money Transfer is renowned for offering competitive exchange rates. This is a crucial aspect for users who need to send money internationally. With real-time rates, users can ensure they get the best value for their money. Xe’s dedication to providing favorable rates makes it a preferred choice among global users.

How Xe Ensures Competitive Rates

Xe employs advanced technology to monitor market trends and fluctuations. This helps to provide live exchange rates for over 100 currencies. By using the mid-market rate, Xe offers transparency and fairness in their currency conversions.

Users can also benefit from Rate Alerts. These alerts notify users when their desired currency pair reaches a specific rate. This feature ensures users can make informed decisions about their transfers.

Furthermore, Xe’s Currency Data API delivers real-time exchange rates to businesses. This ensures businesses can always access accurate and up-to-date currency information.

Benefits For Frequent Users

Frequent users of Xe Money Transfer enjoy several advantages. The platform offers low fees starting at $0 for transfers, depending on the amount and destination. This makes it cost-effective for regular transfers.

Another benefit is the real-time tracking of transfers. Users can monitor their transactions and receive support through live chat, phone, and email. This ensures a smooth and reliable transfer process.

Xe also provides a mobile app for managing currencies and transfers on the go. This adds convenience for users who need to make quick transfers from anywhere.

Additionally, Xe’s service is highly trusted by millions globally. Positive user reviews and high ratings on platforms like Trustpilot highlight the reliability and efficiency of Xe Money Transfer.

With over 30 years of experience, Xe has built a reputation for providing secure and efficient money transfer services. This makes it a top choice for users seeking competitive exchange rates and reliable service.

Global Reach And Coverage

Xe Money Transfer is renowned for its extensive global reach and coverage. With over 30 years of experience, Xe facilitates money transfers to a vast number of countries worldwide, making it a trusted and reliable service for international transactions.

Countries And Currencies Supported

Xe supports transfers to over 190 countries, covering more than 130 currencies. This wide coverage ensures that users can send money to almost any part of the world, providing a seamless experience for both personal and business transactions.

| Region | Supported Countries | Supported Currencies |

|---|---|---|

| North America | USA, Canada, Mexico | USD, CAD, MXN |

| Europe | UK, Germany, France, Spain | GBP, EUR |

| Asia | China, Japan, India | CNY, JPY, INR |

| Australia | Australia, New Zealand | AUD, NZD |

| Africa | South Africa, Nigeria, Kenya | ZAR, NGN, KES |

Cross-border Transfer Efficiency

Xe Money Transfer is known for its fast and secure cross-border transfers. The platform uses real-time exchange rates, ensuring that users get the best possible rate for their transactions.

- Transfer Speed: Transfers are typically processed within minutes to a few hours, depending on the destination and payment method.

- Security: Xe verifies identities to keep money safe and uses advanced encryption technologies.

- Real-Time Tracking: Users can track their transfers in real-time and receive updates via live chat, phone, and email.

These features make Xe a preferred choice for both individuals and businesses looking for efficient cross-border transfer solutions.

User-friendly Interface

Xe Money Transfer offers a user-friendly interface that caters to both new and experienced users. This makes it easy for anyone to navigate and utilize their services effectively.

Ease Of Use For New Users

New users will find the Xe Money Transfer platform intuitive and straightforward. The sign-up process is quick and requires minimal information. Once registered, the dashboard provides easy access to all features.

- Simple Navigation: The layout is clean and well-organized, making it easy to find what you need.

- Guided Steps: The platform guides users through the process of making their first transfer.

- Help and Support: New users can access help via live chat, phone, and email for any questions.

Advanced Features For Experienced Users

Experienced users will appreciate the advanced features offered by Xe Money Transfer. These features enhance the overall user experience and provide more control over transactions.

| Feature | Description |

|---|---|

| Rate Alerts | Set notifications for desired currency rates. |

| Historical Currency Rates | Analyze trends over different periods. |

| IBAN Calculator | Validate IBAN for accurate transfers. |

| Currency Data API | Access real-time exchange rates for businesses. |

These features are designed to provide convenience, security, and efficiency for users. Xe Money Transfer continues to be a trusted platform for global currency conversions and international money transfers.

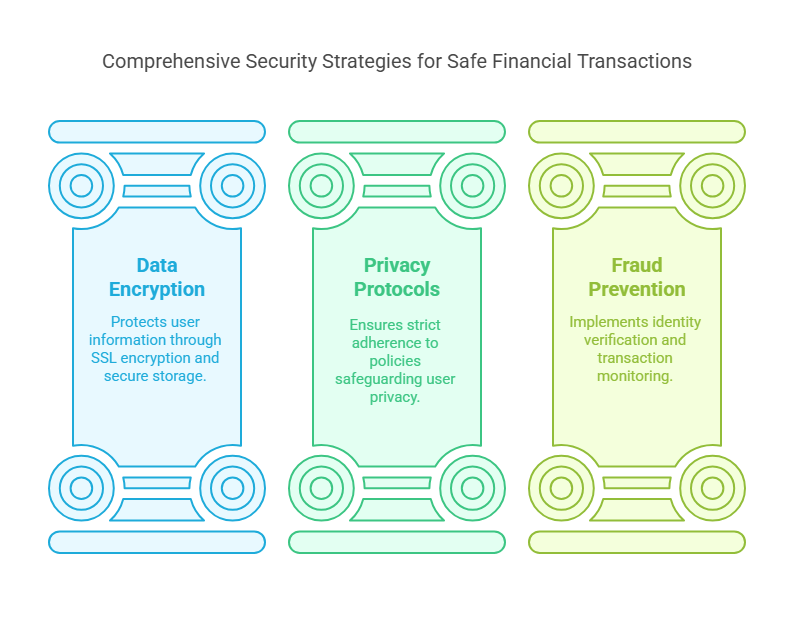

Security Measures

Ensuring the security of financial transactions is crucial. Xe Money Transfer prioritizes user security through advanced measures. These include data encryption, privacy protocols, and fraud prevention strategies.

Data Encryption And Privacy

Xe employs state-of-the-art data encryption to protect user information. All data transmitted between users and the platform is encrypted using SSL (Secure Socket Layer) technology. This ensures that sensitive information remains secure and private.

- SSL Encryption: Protects data during transmission.

- Secure Storage: User data is securely stored in encrypted databases.

- Privacy Protocols: Strict policies to safeguard user privacy.

These measures prevent unauthorized access and ensure that personal and financial information remains confidential.

Fraud Prevention Strategies

Xe Money Transfer has implemented robust fraud prevention strategies. These strategies include identity verification and transaction monitoring to detect suspicious activity.

| Strategy | Description |

|---|---|

| Identity Verification | Verifies user identity to prevent unauthorized access. |

| Transaction Monitoring | Continuously monitors transactions for unusual patterns. |

| Two-Factor Authentication | Requires an additional verification step for added security. |

These strategies help protect users from fraud and ensure that their money transfers are secure. Xe‘s commitment to security provides users with peace of mind when transferring money internationally.

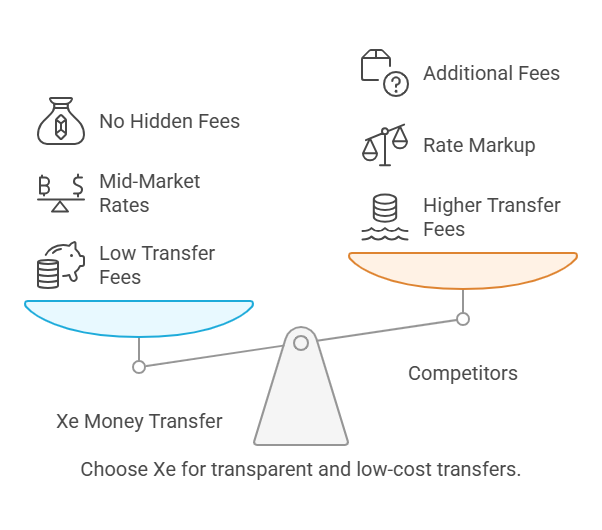

Pricing And Affordability

In 2025, Xe Money Transfer continues to offer competitive pricing and affordability. Their transparent fee structure and low costs make it a preferred choice for many users. Let’s delve into the details.

Fee Structure

Xe Money Transfer prides itself on its low and transparent fee structure. Here are the key details:

- Transfer Fees: Start at $0, depending on the transfer amount and destination.

- Currency Conversion: Uses mid-market rates for conversions. Actual rates may vary slightly when sending money.

- Additional Fees: Generally, no hidden fees. Users can see the total cost before confirming the transfer.

Comparing Costs With Competitors

How does Xe Money Transfer stand against its competitors? Let’s compare:

| Service | Transfer Fee | Exchange Rate Markup | Additional Fees |

|---|---|---|---|

| Xe Money Transfer | Starting at $0 | Mid-market rate | None |

| Competitor A | $5 per transfer | 1-3% above mid-market rate | Service fee for small amounts |

| Competitor B | $3 per transfer | 2% above mid-market rate | No hidden fees |

From the table, it is clear that Xe Money Transfer offers competitive rates. The low fees and use of mid-market rates ensure you get more value for your money.

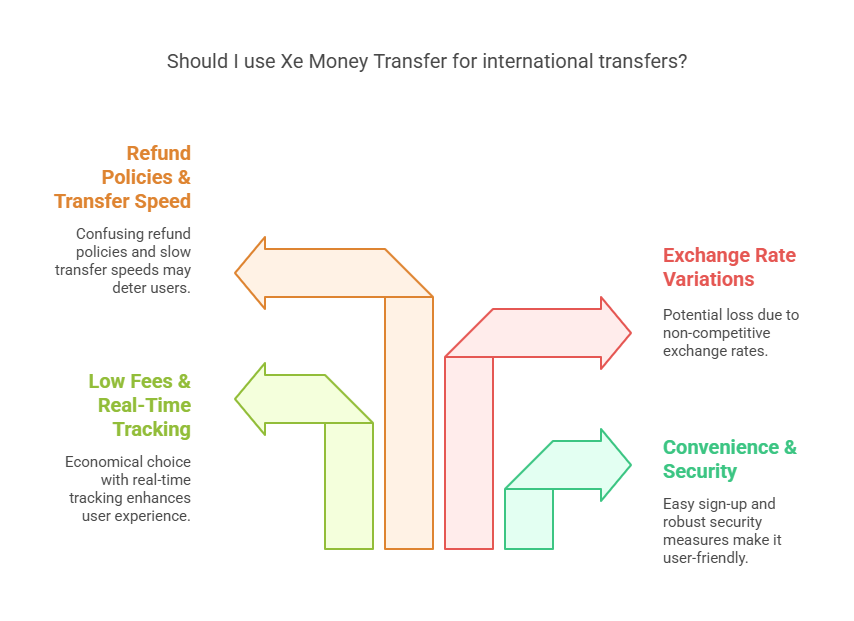

Pros And Cons Of Xe Money Transfer

Xe Money Transfer is a popular service for international money transfers. It offers a range of benefits and some drawbacks. Understanding these can help you decide if it’s right for you.

Advantages Based On User Reviews

- Convenience: Users appreciate the easy sign-up and transfer process.

- Security: Many reviews highlight the secure platform and identity verification.

- Low Fees: Users benefit from fees starting at $0, which is often lower than competitors.

- Real-Time Tracking: The ability to track transfers and receive support via live chat, phone, and email is highly valued.

- Mobile App: The mobile app allows users to manage currencies and transfers on the go.

- Trusted Service: Rated highly on Trustpilot with 4.8/5 from 58.6k ratings, 4.8/5 from 221k ratings, and 4.3/5 from 69.5k ratings.

Common Criticisms And Issues

- Exchange Rate Variations: Some users note that actual rates may vary from mid-market rates when sending money.

- Refund Policies: Specific refund policies are not detailed, causing confusion for some users.

- Transfer Speed: A few users mention that transfers can sometimes take longer than expected.

Xe Money Transfer offers a range of features and benefits, but like any service, it has its pros and cons. Considering user reviews can provide a clearer picture of what to expect.

Ideal Users And Scenarios

Xe Money Transfer is a versatile service catering to a wide range of users. It is ideal for anyone needing to send money internationally securely and affordably.

Best Use Cases

- Frequent Travelers: Travelers can benefit from Xe’s real-time exchange rates and currency conversion tools.

- Expats: Expats can send money back home to over 190 countries with minimal fees.

- Businesses: Companies can use Xe for cross-border payments and managing FX risks.

- Students Abroad: Students studying overseas can receive funds from their families quickly and securely.

Who Benefits The Most From Xe Money Transfer

Frequent Travelers will appreciate the real-time currency conversion. They can compare rates for over 100 currencies and set up rate alerts.

Expats enjoy the convenience of low fees starting at $0. They can track their transfers in real-time via the mobile app.

Businesses benefit from the Currency Data API, which provides real-time exchange rates. They can also validate IBANs for accurate transfers.

Students Abroad and their families find it easy to manage transfers with Xe’s secure platform. The service is trusted by millions globally and offers extensive customer support.

Credit: www.internationalmoneytransfer.com

Frequently Asked Questions

How Reliable Is Xe Money Transfer?

Xe money transfer is reliable, trusted by millions globally. It offers competitive rates, strong security, and excellent customer support.

Who Owns Xe Money Transfer?

Euronet Worldwide owns Xe money transfer. Euronet Worldwide is a global leader in processing secure electronic financial transactions.

Can I Use Xe From The Usa?

Yes, you can use Xe from the USA. Xe supports international money transfers to and from the USA.

Is Xe Better Than Western Union?

Xe and Western Union each have their strengths. Xe often offers better exchange rates and no fees. Western Union provides wider global coverage and faster transfers. Choose based on your specific needs.

Conclusion

Xe Money Transfer stands out for its reliability and ease of use. With low fees and real-time tracking, users can transfer money with confidence. The platform’s user-friendly interface and mobile app add to the convenience. Over 30 years of experience and high ratings ensure you get trusted service.

Consider Xe for your next international money transfer.

Thank you for taking the time to read my article “Xe Money Transfer Review: Is It the Best in 2025?”