Personal Finance Tips 2025 Managing personal finance can be challenging. With evolving economic landscapes, staying informed is crucial.

As we move into 2025, new strategies and tools emerge to help manage finances better. Whether you’re looking to save, invest, or budget, understanding the latest tips can make a big difference. This blog post will cover essential personal finance tips for 2025.

These tips will help you navigate the financial world with confidence. From leveraging technology to making smart investment choices, you’ll find practical advice tailored for the modern financial environment. Stay ahead and secure your financial future with these insightful tips. Let’s dive in and explore how you can optimize your finances in 2025.

Credit: www.planwellfp.com

Introduction To Personal Finance Tips 2025

Managing personal finances is essential, especially in 2025. The financial landscape continues to evolve. New technologies and trends are reshaping how we handle money. This guide provides practical tips to help you navigate these changes effectively.

Why Personal Finance Is Crucial In 2025

In 2025, personal finance plays a vital role in achieving financial stability. With the rise of digital currencies and new financial tools, understanding personal finance is more important than ever. Proper financial management ensures you make informed decisions, protecting your wealth and securing your future.

- Helps you stay prepared for emergencies

- Enables better investment choices

- Reduces financial stress

- Ensures long-term financial security

Overview Of Emerging Trends And Changes

The financial world is constantly changing. In 2025, several emerging trends and changes will impact personal finance:

| Trend | Description |

|---|---|

| Cryptocurrency Adoption | More people are using digital currencies for transactions and investments. |

| Decentralized Finance (DeFi) | DeFi platforms offer alternative financial services without traditional banks. |

| AI and Automation | AI tools help manage budgets, savings, and investments more efficiently. |

| Environmental, Social, and Governance (ESG) Investing | Investors prioritize companies with strong ESG practices. |

These trends highlight the need for staying updated with the latest financial tools and resources. For instance, platforms like Uphold offer innovative solutions. Uphold provides a seamless trading experience, high earning potential through staking rewards, and robust security measures.

Understanding these trends ensures you are well-prepared for 2025. Stay informed and make smart financial decisions to thrive in the new financial landscape.

Credit: www.youtube.com

Budgeting Strategies For The Modern Era

In 2025, budgeting isn’t just about cutting expenses. It’s about using modern tools and strategies to manage finances effectively. The digital age offers numerous resources to make budgeting easier and more efficient.

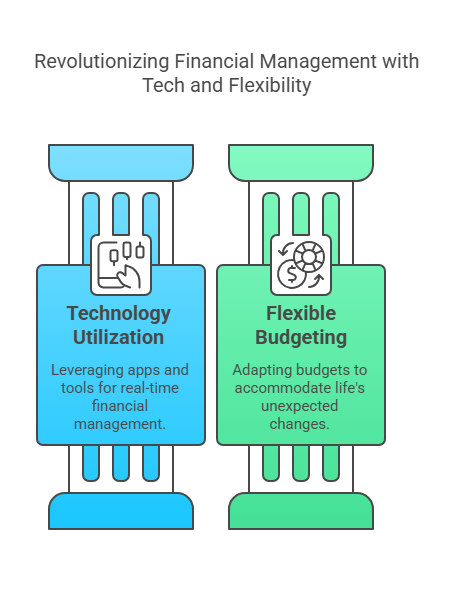

Utilizing Technology For Effective Budgeting

Technology has revolutionized personal finance. Apps and online tools can help you track income and expenses in real-time. They offer automated features to categorize spending and set savings goals.

Consider using apps like Uphold for budgeting and managing your crypto assets. It offers features like one-step trading and staking rewards, which can be beneficial for maintaining financial health. Here’s how technology can assist:

- Automated Expense Tracking: Connect your bank accounts to an app to monitor transactions.

- Budget Alerts: Set up alerts for when you approach your spending limits.

- Financial Reports: Generate reports to understand your spending habits.

Creating A Flexible Budget To Adapt To Changes

In today’s fast-paced world, having a flexible budget is crucial. Life changes quickly, and your budget should be able to adapt. Here’s how to create a flexible budget:

| Step | Description |

|---|---|

| 1. Assess Your Income | Include all sources of income, fixed and variable. |

| 2. List Your Expenses | Divide expenses into fixed (rent) and variable (groceries). |

| 3. Set Priorities | Determine which expenses are essential and which can be adjusted. |

| 4. Monitor and Adjust | Review your budget monthly and make necessary changes. |

A flexible budget helps you manage unexpected expenses without derailing your financial plan. This adaptability ensures you stay on track with your financial goals.

By combining modern technology with a flexible approach, you can create a robust budgeting strategy that works for you in 2025.

Smart Saving Techniques

In 2025, mastering smart saving techniques is crucial for financial stability. Adopting innovative methods can help maximize your savings. Let’s explore some effective strategies to manage your finances better.

Automated Savings Plans And Tools

Automated savings plans are essential for consistent saving. They ensure money is set aside without requiring constant attention. Setting up these plans can be simple and highly effective.

- Direct Deposit: Allocate a portion of your paycheck to a savings account.

- Saving Apps: Use apps like Acorns or Chime. These apps round up purchases and save the difference.

- Bank Programs: Many banks offer automatic transfer options. Set a schedule to transfer funds from checking to savings.

These tools help build a habit of saving regularly and effortlessly.

High-interest Savings Accounts And Alternatives

High-interest savings accounts offer better returns on your deposits. They are a secure way to grow your savings over time.

| Account Type | Interest Rate | Features |

|---|---|---|

| High-Interest Savings Account | 0.50% – 1.50% | No risk, FDIC insured |

| Money Market Account | 0.70% – 2.00% | Higher interest with check-writing abilities |

| Certificate of Deposit (CD) | 1.00% – 3.00% | Fixed term, higher rates |

Consider alternatives like Uphold for higher earnings. Uphold offers up to 14.4% APY through staking rewards. This can significantly boost your savings over time.

Utilize these smart saving techniques to enhance your financial growth. Choose tools and accounts that align with your financial goals.

Credit: linkfinancial.solutions

Investment Opportunities In 2025

The year 2025 promises to bring exciting investment opportunities. With the rise of new technologies and growing awareness of sustainability, investors have multiple avenues to explore. Below, we delve into two promising investment areas: cryptocurrency and digital assets, and sustainable and ethical investments.

Exploring Cryptocurrency And Digital Assets

Cryptocurrency and digital assets remain a vibrant space for investment in 2025. Platforms like Uphold offer a seamless experience for trading and securing a wide range of cryptoassets.

- Discover New Tokens Early: Uphold connects to multiple trading venues. This allows users to access a broad spectrum of cryptoassets.

- Simple, One-Step Trading: The platform enables easy trading between any supported assets. For instance, you can trade Bitcoin to XRP effortlessly.

- Staking Rewards: Earn up to 14.4% APY on over 19 digital assets.

- Radical Transparency: Uphold publishes assets and liabilities every 30 seconds, ensuring transparency.

Investing in cryptocurrency involves risks, but with platforms like Uphold, the process becomes more secure and manageable. Their commitment to security and trust through certifications like SOC 2 Type 2 and ISO 27001 is commendable.

Sustainable And Ethical Investment Options

Investors are increasingly interested in sustainable and ethical investment options. These investments not only promise returns but also contribute to a better world.

- Environmental, Social, and Governance (ESG) Funds: ESG funds focus on companies that meet high environmental, social, and governance standards.

- Green Bonds: These are fixed-income securities designed to support environmental projects.

- Socially Responsible Investing (SRI): SRI strategies consider both financial return and social/environmental good.

By choosing sustainable and ethical investments, you support companies committed to positive change. This approach not only benefits the environment and society but also aligns with the growing trend of conscious investing.

Managing Debt Wisely

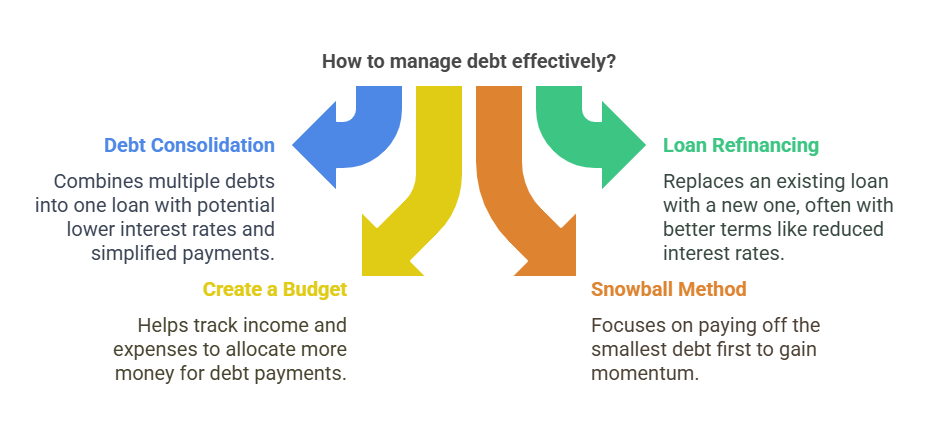

Managing debt is crucial for financial health in 2025. With the right strategies, you can control your debt and improve your financial situation. This section will discuss options for debt consolidation and refinancing, as well as strategies to pay down debt efficiently.

Consolidation And Refinancing Options

Consolidation and refinancing can simplify your debt management. Here’s a breakdown of each:

| Option | Description | Benefits |

|---|---|---|

| Debt Consolidation | Combines multiple debts into one loan with a single payment. |

|

| Refinancing | Replaces an existing loan with a new one, often with better terms. |

|

Strategies To Pay Down Debt Efficiently

Paying down debt efficiently requires a strategic approach. Consider these strategies:

- Create a Budget: Track income and expenses to find extra money for debt payments.

- Snowball Method: Focus on paying off the smallest debt first. Then, move to the next smallest.

- Avalanche Method: Pay off debts with the highest interest rates first. Save money on interest over time.

- Automate Payments: Set up automatic payments to avoid late fees and stay on track.

- Negotiate Terms: Contact creditors to negotiate lower interest rates or better terms.

By consolidating or refinancing, you can simplify your debt management. Use strategic methods to pay down debt efficiently and improve your financial health.

Maximizing Retirement Savings

In 2025, retirement savings strategies are evolving. Maximizing your retirement savings is crucial for a secure future. Understanding new plans and balancing goals can help you achieve financial stability.

Understanding New Retirement Plans

New retirement plans offer more flexibility and benefits. It’s essential to understand the options available. Here’s a quick overview of some modern plans:

| Plan Type | Key Features |

|---|---|

| 401(k) Plans | Higher contribution limits, employer matching, tax advantages |

| Roth IRAs | Tax-free withdrawals, no required minimum distributions |

| Solo 401(k) Plans | Ideal for self-employed individuals, higher contribution limits |

Choosing the right plan depends on your employment status and financial goals. Evaluate each option carefully.

Balancing Short-term And Long-term Goals

Balancing short-term needs and long-term goals is challenging but essential. Here are some tips to find the right balance:

- Set Clear Goals: Define both short-term and long-term financial objectives.

- Create a Budget: Allocate funds for daily expenses and retirement savings.

- Emergency Fund: Maintain an emergency fund to cover unexpected expenses.

- Automate Savings: Set up automatic transfers to your retirement accounts.

- Review Regularly: Periodically review and adjust your financial plans.

By setting clear goals and managing your budget, you can ensure a balanced approach to saving for retirement while addressing immediate needs.

For those interested in cryptocurrency investments, platforms like Uphold offer opportunities to diversify your portfolio. Uphold provides a secure and transparent environment to trade and earn on cryptoassets, potentially boosting your retirement savings.

Visit Uphold to explore their services and start securing your financial future today.

Insurance And Risk Management

Managing your finances involves more than just saving and investing. Insurance and risk management are crucial aspects that protect you from unexpected financial burdens. In 2025, it’s essential to understand modern insurance products and how to assess and mitigate financial risks effectively.

Modern Insurance Products To Consider

In 2025, several innovative insurance products can provide better coverage and peace of mind. These products cater to the evolving needs of individuals and families.

- Usage-Based Insurance: Charges premiums based on actual usage, ideal for infrequent drivers.

- Cyber Insurance: Protects against data breaches and cyber-attacks, essential for businesses and individuals.

- Health Savings Accounts (HSAs): Combines health insurance with savings, offering tax advantages.

- Pet Insurance: Covers veterinary expenses, ensuring your pets receive proper care.

Assessing And Mitigating Financial Risks

Effective risk management involves identifying potential financial risks and implementing strategies to minimize their impact. Here are some steps to help you assess and mitigate financial risks:

- Identify Risks: List all possible financial risks, such as job loss, medical emergencies, and market downturns.

- Evaluate Impact: Assess the potential impact of each risk on your finances.

- Develop a Plan: Create a plan to address each risk, including emergency savings and appropriate insurance coverage.

- Diversify Investments: Spread your investments across different asset classes to reduce exposure to any single risk.

- Regular Review: Periodically review and update your risk management plan to ensure it remains relevant.

Implementing a comprehensive insurance and risk management strategy in 2025 can safeguard your financial future. By staying informed about modern insurance products and regularly assessing risks, you can better protect yourself and your family from unforeseen financial challenges.

Leveraging Financial Advisors And Tools

2025 brings new opportunities to manage your finances smartly. Financial advisors and tools can help navigate this landscape. Here’s how you can use them effectively.

Choosing The Right Financial Advisor

Selecting the right advisor is crucial. Begin by assessing their qualifications and experience. Look for certifications like CFP or CFA. These indicate a high level of expertise.

Consider their specialization. Some advisors focus on retirement planning, while others excel in tax strategies. Choose one that aligns with your specific needs.

Evaluate their fee structure. Advisors can charge hourly, a flat fee, or a percentage of assets. Understand what you are comfortable with before making a decision.

Lastly, assess their communication style. You should feel comfortable discussing your financial goals with them. A good advisor listens and provides clear, actionable advice.

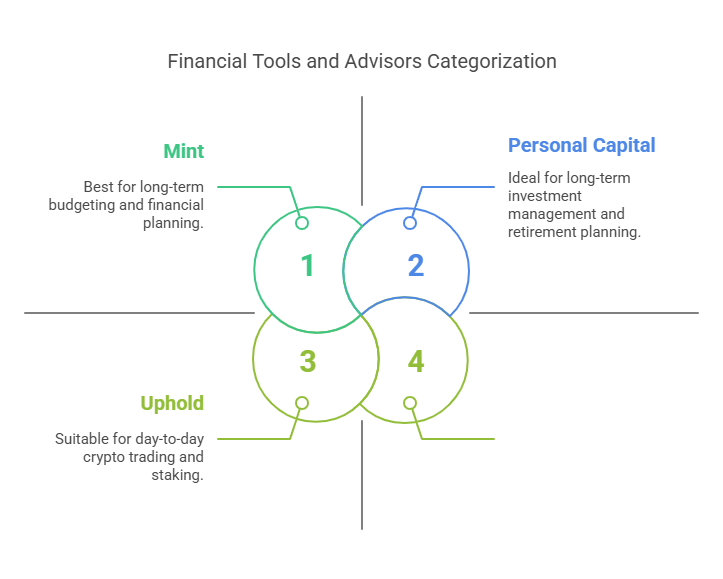

Top Financial Planning Tools And Apps

2025 offers a plethora of financial tools. Here are some top choices:

- Mint: Great for budget tracking and expense management.

- Personal Capital: Excellent for investment tracking and retirement planning.

- Uphold: Perfect for those investing in cryptocurrencies. It offers one-step trading and staking rewards up to 14.4% APY.

Comparing these tools can help find the best fit for your needs. Here’s a quick comparison:

| Tool | Features | Best For |

|---|---|---|

| Mint | Budget tracking, Expense management | Day-to-day budgeting |

| Personal Capital | Investment tracking, Retirement planning | Long-term planning |

| Uphold | One-step trading, Staking rewards | Crypto investments |

Using these tools can streamline your financial planning process. Each offers unique features to help you stay on track with your goals.

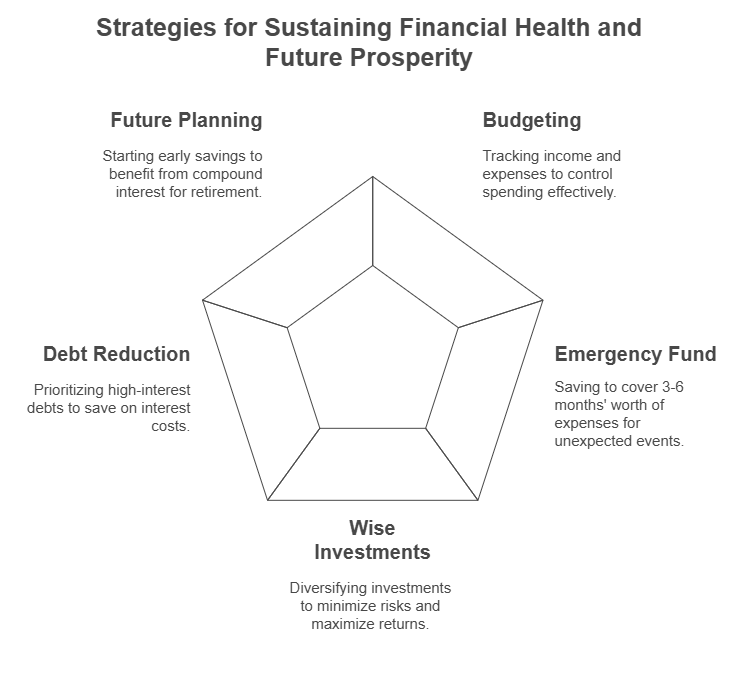

Conclusion And Future Outlook

As we approach 2025, it’s important to reflect on personal finance tips and prepare for what lies beyond. Understanding these fundamentals will help maintain financial health and adapt to future changes.

Recap Of Essential Tips

- Create a Budget: Track income and expenses to control spending.

- Build an Emergency Fund: Save at least 3-6 months’ worth of expenses.

- Invest Wisely: Diversify investments to minimize risks.

- Reduce Debt: Prioritize high-interest debts to save on interest.

- Plan for Retirement: Start saving early to benefit from compound interest.

Preparing For The Financial Landscape Beyond 2025

Looking beyond 2025, it’s crucial to stay informed about emerging financial trends and technologies. The financial landscape is constantly evolving, and adapting to these changes is key.

Consider these strategies:

- Embrace Technology: Utilize platforms like Uphold for cryptocurrency trading and staking rewards.

- Stay Informed: Keep up with market updates and educational resources.

- Focus on Security: Choose platforms with strong security certifications like SOC 2 Type 2 and ISO 27001.

- Adopt Sustainable Practices: Make environmentally and socially responsible investment choices.

By following these tips and staying adaptable, you can navigate the financial challenges and opportunities that lie ahead. Preparing now will ensure a secure and prosperous future.

Frequently Asked Questions

What Are The Predictions For 2025 Personal Finance?

Predictions for 2025 personal finance include increased use of digital banking, AI-driven financial planning, and a rise in sustainable investing.

How To Manage Finances In 2025?

Manage finances in 2025 by creating a budget, tracking expenses, investing wisely, using digital tools, and saving regularly. Stay informed about market trends and adjust strategies as needed. Prioritize debt repayment and build an emergency fund.

What Are Some Financial Goals For 2025?

Some financial goals for 2025 include saving for retirement, building an emergency fund, paying off debt, and investing in education.

What Is The 70/30 Rule In Personal Finance?

The 70/30 rule in personal finance suggests allocating 70% of income to expenses and 30% to savings and investments. This helps manage spending while ensuring financial growth.

Conclusion

Managing your finances wisely in 2025 is crucial. Implementing these personal finance tips can help you achieve financial stability. Keep budgeting simple and track your expenses regularly. Focus on saving and investing smartly to grow your wealth. Use tools like Uphold for secure and transparent cryptocurrency trading.

Start small but stay consistent with your financial goals. Remember, every small step towards better financial management counts. Stay informed, stay disciplined, and your future self will thank you.

Thank you for taking the time to read my article “2025 Personal Finance Tips: Smart Ways to Grow Your Wealth”