Mortgage Research Center, LLC is a trusted name in the loan and financial services industry. It helps individuals navigate the often-confusing mortgage process, making homeownership more accessible.

Finding the right mortgage can be overwhelming with so many options and complex terms. Mortgage Research Center, LLC aims to simplify this by offering expert guidance and resources. While specific product details and pricing are not readily available, the company’s mission is clear—providing valuable mortgage information and support.

This review will explore the company’s offerings, user experiences, and overall reputation. By the end, you’ll have a better understanding of whether Mortgage Research Center, LLC is the right fit for your home financing needs.

Introduction to Mortgage Research Center, LLC

Mortgage Research Center, LLC is a leading company in the mortgage and financial services industry. It helps individuals navigate the often-complex home loan process, offering expert guidance and valuable insights.

Overview of Mortgage Research Center, LLC

Founded in 2004 and headquartered in Columbia, Missouri, Mortgage Research Center, LLC serves clients nationwide. The company specializes in providing mortgage advice tailored to different types of homebuyers, including first-time buyers, veterans, and experienced investors.

Key Highlights

- Founded: 2004

- Headquarters: Columbia, Missouri

- Service Area: Nationwide

- Expertise: Mortgage guidance for all types of homebuyers

Mission and Purpose

Mortgage Research Center, LLC is dedicated to simplifying the mortgage process. Its mission is to provide clear, accurate, and personalized mortgage advice so clients can make informed financial decisions.

The company focuses on:

- Offering expert mortgage insights

- Providing personalized service for every client

- Ensuring transparency in all communications

- Helping clients achieve homeownership with confidence

With a strong commitment to integrity and client satisfaction, Mortgage Research Center, LLC makes home financing easier and more accessible for everyone.

Key Features of Mortgage Research Center, LLC

Mortgage Research Center, LLC simplifies the mortgage process with a range of services tailored to different homebuyers. From expert guidance to user-friendly tools, they provide everything needed to make informed mortgage decisions.

Comprehensive Mortgage Solutions

Whether you’re a first-time homebuyer or looking to refinance, Mortgage Research Center, LLC offers customized mortgage plans to fit individual financial situations. Their goal is to make the process as smooth and stress-free as possible.

User-Friendly Online Platform

The company’s intuitive online platform makes navigating the mortgage process easy. With just a few clicks, users can access essential tools, compare options, and find the information they need to make smart decisions.

Expert Consultation Services

Mortgage Research Center, LLC provides personalized mortgage consultations from experienced professionals. Their experts guide clients through every step, helping them understand loan options and find the best solutions for their needs.

Educational Resources & Tools

The company offers a variety of educational resources, including mortgage calculators, guides, and industry insights. These tools break down complex mortgage concepts, empowering clients to make confident financial choices.

Pricing & Affordability Breakdown

Understanding mortgage service costs is essential for making informed financial decisions. Below is a breakdown of Mortgage Research Center, LLC’s pricing structure, how it compares to competitors and the overall value it offers.

Cost of Services

Mortgage Research Center, LLC does not publicly disclose its pricing. To get an exact quote, clients must contact them directly. However, typical mortgage service costs may include:

| Service | Estimated Cost |

|---|---|

| Application Fee | $300 – $500 |

| Origination Fee | 0.5% – 1% of the loan amount |

| Miscellaneous Fees | Varies (e.g., underwriting, processing) |

Since costs can vary based on loan type and borrower profile, reaching out for a personalized estimate is recommended.

Comparison with Competitors

To gauge affordability, here’s how competitors typically price their services:

| Company | Application Fee | Origination Fee |

|---|---|---|

| Company A | $450 | 1% |

| Company B | $300 | 0.75% |

| Company C | $500 | 1.25% |

While Mortgage Research Center, LLC does not list exact prices, its fees likely align with industry standards. Comparing options helps determine the best fit.

Value for Money

Beyond pricing, overall value depends on service quality, efficiency, and loan success rates. Mortgage Research Center, LLC likely offers strong value through:

- Fast application processing

- Expert guidance from mortgage professionals

- Personalized loan solutions

Considering these factors, Mortgage Research Center, LLC may be a solid choice for those seeking expert mortgage assistance at competitive rates.

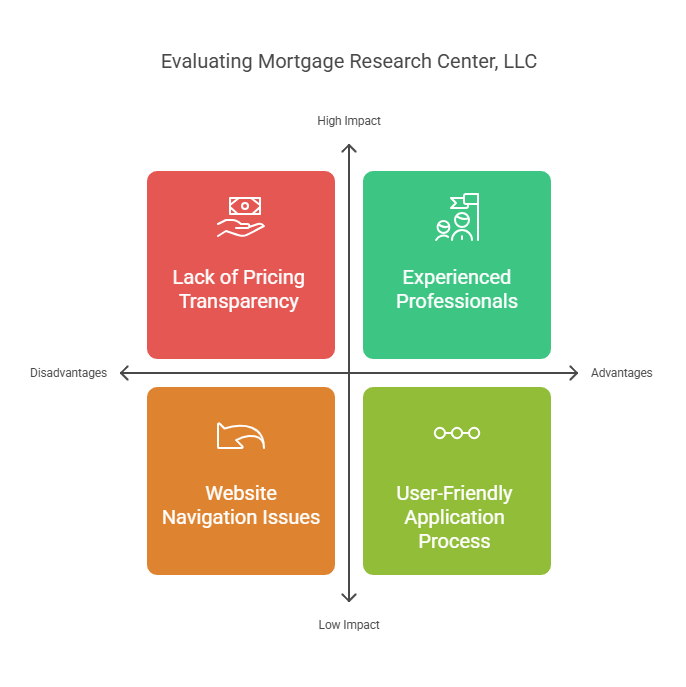

Pros & Cons Based on Real-World Usage

Mortgage Research Center, LLC offers various financial services, but like any company, it has strengths and weaknesses. Below is a balanced look at its advantages and limitations based on user experiences.

Advantages of Using Mortgage Research Center, LLC

✅ Experienced Professionals – The team consists of knowledgeable experts who guide clients through the mortgage process.

✅ Comprehensive Services – Offers a variety of financial solutions, including mortgage loans and refinancing options.

✅ Responsive Customer Support – Many users highlight positive interactions with helpful and prompt support representatives.

✅ User-Friendly Application Process – The mortgage application is straightforward and designed for ease of use.

✅ Informative Resources – Provides educational content to help clients make well-informed financial decisions.

Potential Drawbacks & Limitations

❌ Lack of Pricing Transparency – No clear details on costs, requiring users to contact the company directly.

❌ Limited Product Information – The website does not provide in-depth descriptions of mortgage options or benefits.

❌ Unclear Policies – No publicly available refund, return, or cancellation policies.

❌ Website Navigation Issues – Some users report difficulty finding relevant information on the site.

Ideal Users & Best Use Cases for Mortgage Research Center, LLC

Mortgage Research Center, LLC serves a diverse range of users, helping them navigate the mortgage process with expert guidance. Below, we break down who benefits most from their services and the best scenarios to use them.

Who Should Use Mortgage Research Center, LLC?

✅ First-Time Homebuyers – Ideal for those new to homeownership. They offer valuable insights and step-by-step guidance.

✅ Veterans & Active Military – Specializes in VA loans, ensuring military personnel receive the best possible mortgage options.

✅ Homeowners Looking to Refinance – Helps individuals find better rates and terms for their existing mortgage.

✅ Real Estate Investors – Offers financing options tailored to investment properties and unique lending needs.

Best Use Cases & Scenarios

📌 Applying for a New Mortgage – Simplifies the mortgage application process, making it easier to secure financing.

📌 Researching Loan Options – Provides in-depth comparisons to help borrowers choose the right mortgage.

📌 Improving Credit Scores – Offers guidance on enhancing credit scores to qualify for better mortgage terms.

📌 Understanding VA Loans – Military personnel can receive expert support and advice on VA loan benefits.

📌 Refinancing an Existing Loan – Assists homeowners in securing lower interest rates or better loan terms.

Frequently Asked Questions

What is Mortgage Research Center, LLC?

Mortgage Research Center, LLC provides mortgage-related services and resources to help homebuyers and borrowers navigate the loan process.

Is Mortgage Research Center, LLC reputable?

Yes, Mortgage Research Center, LLC has a strong reputation for offering reliable mortgage services, with positive reviews from users.

What services does Mortgage Research Center, LLC offer?

They provide loan origination, refinancing options, and educational resources to help borrowers make informed decisions.

How can I contact Mortgage Research Center, LLC?

You can reach them via their website, phone, or email for inquiries and customer support.

Conclusion

Mortgage Research Center, LLC provides valuable mortgage services with a professional and knowledgeable team. Their customer support is praised for being helpful and responsive. Whether you’re a first-time homebuyer or looking to refinance, they simplify the process and guide you through each step.

For more information, visit their website. Trust Mortgage Research Center, LLC to make your mortgage journey easier.

Thank you for taking the time to read my article “Mortgage Research Center, Llc Review: In-Depth Analysis and Insights”