In a world where financial literacy is crucial, the Greenlight Debit Card for kids has become a popular tool for families. As we look ahead to 2025, many parents seek reliable reviews to understand its benefits and features.

Greenlight is more than just a debit card for kids; it’s a comprehensive financial literacy app designed for families. This app not only helps children learn about earning, saving, and investing, but it also provides parents with the tools to guide and monitor their kids’ financial activities.

With features like chore assignments, automated allowances, and a financial literacy game, Greenlight offers an engaging way for kids to manage their money. Additionally, safety features such as location sharing and SOS alerts ensure peace of mind for parents. Join us as we delve into detailed reviews of the Greenlight Debit Card in 2025, exploring its impact on family financial education.

Introduction To Greenlight Debit Card

The Greenlight Debit Card is more than just a payment tool. It’s an educational platform designed to teach kids financial responsibility. This debit card, combined with the Greenlight app, offers a unique way for families to learn about money management.

What Is Greenlight Debit Card?

The Greenlight Debit Card is a financial tool for kids and teens. It helps them manage their money with the guidance of their parents. The card allows them to spend wisely, set savings goals, and track their balances. Parents can monitor and guide their financial activities through the app.

Purpose And Target Audience

The purpose of the Greenlight Debit Card is to educate kids about money. It targets families with children and teens. The card allows kids to learn about earning, saving, and investing. The app also includes features for parents to assign chores and automate allowances.

Overview Of 2025 Updates

In 2025, Greenlight introduced several updates to enhance the user experience. These updates include:

- Improved Financial Literacy Game (Greenlight Level Up™) to make learning about money more engaging.

- Enhanced Family Safety Hub with features like location sharing, SOS alerts, crash detection, and real-time driving reports.

- An upgraded Savings Growth Calculator to better project savings growth over time.

- New investment options for kids, with parental approval on trades.

These updates aim to provide a more comprehensive educational experience for kids and peace of mind for parents.

With plans starting at $5.99/month, Greenlight offers a range of pricing options to fit different family needs. Each plan includes a one-month risk-free trial, allowing families to explore the app’s benefits before committing.

To learn more about the Greenlight Debit Card and its features, visit the Greenlight website.

Key Features Of Greenlight Debit Card

The Greenlight Debit Card is a smart tool for teaching kids about money. Its features are designed to help parents guide their children’s financial journey. Below are some key features that make Greenlight stand out.

Parental Controls And Monitoring

Parents can have full control over their child’s spending. They can monitor transactions and set spending limits. This ensures that kids learn to manage their money wisely. It also gives parents peace of mind.

Financial Education Tools

Greenlight offers a unique financial literacy game called Greenlight Level Up™. This game teaches kids important money concepts in a fun way. Kids can learn about earning, saving, and investing. The app also includes a Savings Growth Calculator to show the power of compound interest.

Customizable Spending Limits

Parents can set specific spending limits for different categories. These could include shopping, dining, or online purchases. This helps kids understand budgeting and prioritizing expenses. It also prevents overspending in any one area.

Instant Transfers And Notifications

With Greenlight, parents can instantly transfer money to their child’s debit card. They receive real-time notifications for every transaction. This keeps parents in the loop and allows for immediate intervention if needed.

Interest On Savings

Greenlight offers attractive interest rates on savings. The rates vary based on the plan:

| Plan | Interest Rate |

|---|---|

| Greenlight Core | 2% per annum |

| Greenlight Max | 3% per annum |

| Greenlight Infinity | 5% per annum |

These interest rates encourage kids to save more. They can see their savings grow over time, which is a great incentive.

Pricing And Affordability

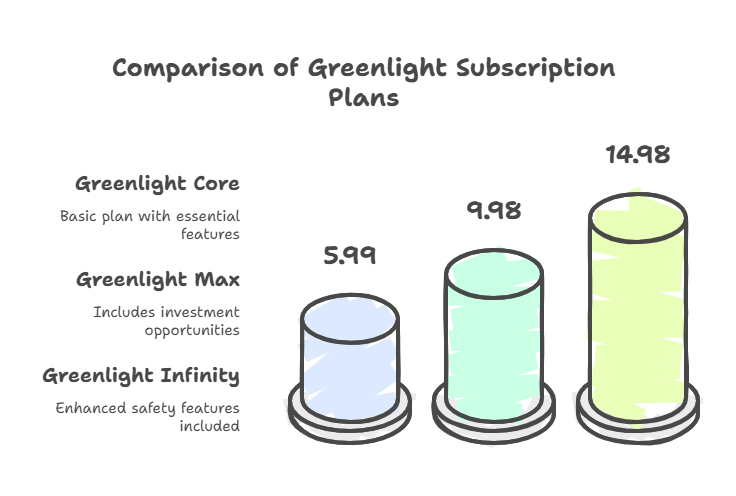

The Greenlight Debit Card for Kids offers various pricing plans to cater to families’ needs. The app provides financial education and safety features at affordable rates. Here’s a detailed look at the pricing and affordability of Greenlight in 2025.

Subscription Plans

| Plan | Monthly Fee | Savings Rewards | Features |

|---|---|---|---|

| Greenlight Core | $5.99 | 2% per annum on savings | Debit card, chore assignments, automated allowances |

| Greenlight Max | $9.98 | 3% per annum on savings | All Core features + investment opportunities |

| Greenlight Infinity | $14.98 | 5% per annum on savings | All Max features + enhanced safety features |

Additional Fees

- No hidden fees

- Clear and transparent pricing

Greenlight prides itself on no hidden fees. The subscription covers all main features, ensuring clear and transparent pricing for families.

Comparison With Competitors

Compared to other financial literacy apps, Greenlight stands out with its comprehensive features and affordability.

| Feature | Greenlight | Competitor A | Competitor B |

|---|---|---|---|

| Monthly Fee | Starts at $5.99 | Starts at $7.99 | Starts at $6.99 |

| Financial Literacy Tools | Yes | Yes | No |

| Safety Features | Yes | No | No |

| Investment Opportunities | Yes | No | Yes |

Greenlight offers a balance of affordable pricing and comprehensive features that make it a standout choice for families.

Pros And Cons Based On Real-world Usage

The Greenlight Debit Card for kids offers a unique approach to teaching financial literacy. Below, we explore the advantages and drawbacks based on real-world usage and user reviews.

Advantages Of Using Greenlight

- Educational Value: Greenlight teaches kids about money management through real-world practice. Features like savings goals, chore assignments, and automated allowances help kids understand financial responsibility.

- Safety Features: The Family Safety Hub includes location sharing, SOS alerts, crash detection, and driving reports. These features ensure family members can stay connected and safe.

- Investment Opportunities: Kids can start investing with parental approval. This introduces them to investing concepts early on.

- Customizable Experience: Parents can set flexible controls and tailor the app experience for their kids. This ensures that the app meets the unique needs of each family member.

- Transparent Pricing: The pricing is clear with no hidden fees. Plans start at $5.99/month and cover the whole family, including up to five kids.

Common Drawbacks And Issues

- Monthly Fee: Despite the many features, some users find the $5.99/month fee steep, especially for larger families.

- Technical Glitches: Some users have reported occasional glitches in the app, such as delayed updates or errors in transaction history.

- Parental Oversight Required: While the app offers many controls, it still requires active parental involvement to monitor and guide kids’ financial activities.

User Testimonials And Reviews

Here are some real-world experiences shared by Greenlight users:

| User | Testimonial |

|---|---|

| Jane D. | “Greenlight has been a game-changer for teaching my kids about money. They love the app, and I love the safety features.” |

| Mike S. | “The monthly fee is a bit high, but the investment opportunities for my teens are worth it.” |

| Emily R. | “We experienced some technical issues, but the customer service was helpful in resolving them.” |

Recommendations For Ideal Users Or Scenarios

The Greenlight Debit Card is designed to help families teach kids about financial literacy. It offers a range of features that can be beneficial in various situations. Here are some ideal scenarios and users for this app.

Best Situations To Use Greenlight Debit Card

- Teaching Financial Literacy: Ideal for parents who want to teach their kids about earning, saving, and investing.

- Chore Management: Perfect for families who use chore assignments and automated allowances to instill responsibility.

- Safety and Monitoring: Beneficial for families who value safety features like location sharing and SOS alerts.

- Early Investment Education: Suitable for parents who wish to introduce their kids to investing with controlled parental oversight.

- Savings Goals: Great for children who are learning to set and achieve savings goals, with tools like the savings growth calculator.

Who Should Avoid It?

- Families on a Tight Budget: The monthly plans start at $5.99, which might be a concern for some families.

- Older Teens: Teens who are already financially literate may find the features less useful.

- Families Not Interested in Digital Tools: Those who prefer traditional methods of teaching financial responsibility may not benefit much.

Alternatives For Different Needs

| Alternative | Best For | Key Features |

|---|---|---|

| FamZoo | Families needing custom allowances | Offers customizable chores, allowances, and family banking |

| GoHenry | Parents seeking detailed spending insights | Provides real-time spending notifications and insights |

| BusyKid | Families focused on earning through chores | Allows kids to earn money through chores and manage their funds |

Credit: www.kidsmoney.org

Conclusion And Final Thoughts

The Greenlight Debit Card has proven to be a valuable tool for families. It not only teaches kids financial literacy but also ensures their safety. As we wrap up our review, let’s summarize the key points, explore the future outlook for Greenlight, and provide a final recommendation.

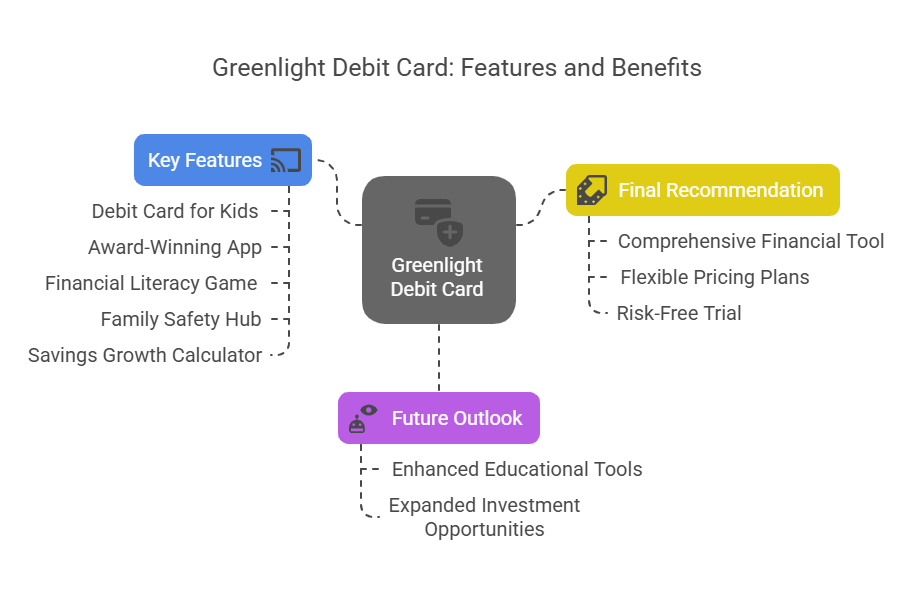

Summary Of Key Points

| Feature | Details |

|---|---|

| Debit Card for Kids | Enables kids to spend wisely, track balances, and set savings goals. |

| Award-Winning App | Offers tailored experiences for parents and kids, including chore assignments and automated allowances. |

| Financial Literacy Game | Teaches kids critical money concepts in an engaging way. |

| Family Safety Hub | Includes location sharing, SOS alerts, crash detection, and driving reports with real-time alerts. |

| Savings Growth Calculator | Explores the power of compound interest and projects savings growth over time. |

Future Outlook For Greenlight Debit Card

Looking ahead, Greenlight aims to continue enhancing its features. The focus will likely be on expanding educational tools and safety measures. As technology advances, the app may integrate more sophisticated financial learning modules. This will help kids understand complex financial concepts in a simplified manner.

Investment opportunities for kids are expected to grow. With parental approval, kids can learn to invest wisely, setting them up for financial success in the future. Greenlight’s commitment to transparency and no hidden fees will continue to be a significant selling point.

Final Recommendation

For families seeking a comprehensive financial tool, Greenlight offers a robust solution. Its combination of educational features, safety tools, and investment opportunities make it a standout choice. The flexible pricing plans starting at $5.99/month ensure accessibility for many families.

The one-month risk-free trial provides a chance to explore the app without commitment. This is a great opportunity to see if Greenlight fits your family’s needs. Considering all these factors, Greenlight is highly recommended for parents looking to teach their kids financial responsibility and ensure their safety.

Frequently Asked Questions

Is The Greenlight Card Being Discontinued?

No, the Greenlight card is not being discontinued. It remains available for families to manage and teach finances.

What Are The Disadvantages Of Greenlight Cards?

Greenlight cards have monthly fees. Some features may require additional costs. Limited acceptance compared to traditional debit cards. No credit-building benefits.

How Trustworthy Is Greenlight?

Greenlight is highly trustworthy. It has excellent user reviews and robust security measures. Parents and kids love its features.

Is A Greenlight Debit Card Worth It?

Yes, a Greenlight debit card is worth it. It offers parental controls, financial education, and spending management for kids.

Conclusion

Greenlight offers a comprehensive financial learning tool for families. Kids learn about money management. Parents get control and safety features. The app makes financial education fun and engaging. With flexible pricing, it’s accessible for many families. Try Greenlight today and start teaching financial literacy at home.

Thank you for taking the time to read my article “Greenlight Debit Card Reviews 2025: The Ultimate Guide”