Cash flow is the lifeblood of any small business. In 2025, improving cash flow will be crucial for growth.

Small businesses often struggle with managing their finances. NorthOne Business Banking offers a solution. This app helps streamline financial tasks, making it easier to track and manage cash flow. With features designed for small businesses, it offers real-time insights and tools to keep your finances in check.

As we move into 2025, finding efficient ways to enhance cash flow will be essential. Using the right tools, like NorthOne, can make a significant difference. In this blog, we will explore various strategies and tools to help you boost your small business cash flow in 2025. Stay tuned to learn more about optimizing your financial management.

Introduction To Cash Flow Management For Small Businesses

Cash flow management is crucial for small businesses. It ensures that there is always enough cash to meet expenses. This guide explains cash flow management and its importance.

Understanding The Importance Of Cash Flow

Cash flow is the money moving in and out of your business. Positive cash flow means more money coming in than going out. Negative cash flow is the opposite. Managing cash flow helps avoid cash shortages.

- Ensures business survival: Without cash, you can’t pay bills.

- Affects decision-making: Knowing your cash flow helps plan purchases and investments.

- Builds trust: Reliable cash flow management builds trust with suppliers and investors.

How Cash Flow Impacts Small Business Growth

Positive cash flow leads to growth opportunities. It allows reinvestment in the business.

- Hiring more staff: More employees can increase productivity.

- Expanding services or products: Offering more can attract new customers.

- Upgrading equipment: Better tools can improve efficiency.

Negative cash flow limits growth. It may force businesses to cut costs or delay expansion plans.

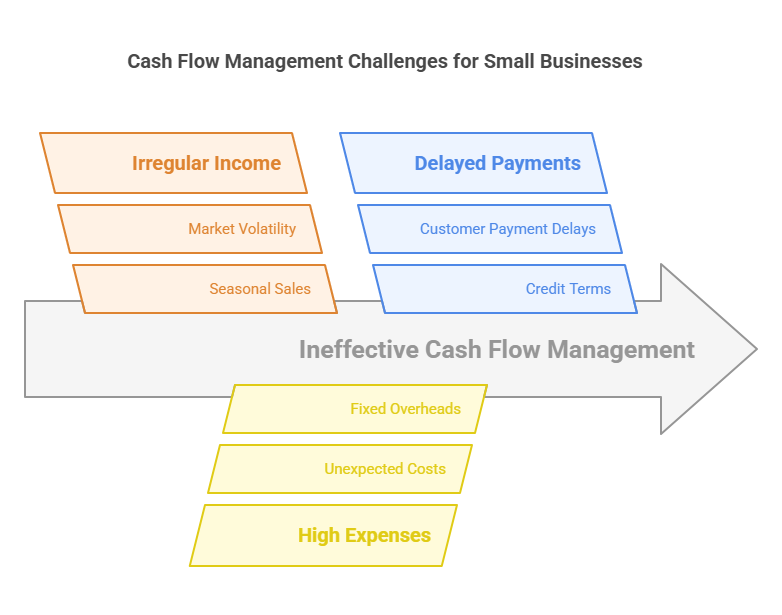

The Challenges Small Businesses Face In Managing Cash Flow

Small businesses face many challenges in managing cash flow.

- Irregular income: Income can be unpredictable, especially for seasonal businesses.

- High expenses: Unexpected expenses can strain cash flow.

- Delayed payments: Customers may not pay on time, affecting cash availability.

Effective cash flow management involves planning and monitoring. Use tools like NorthOne Business Banking to help manage cash flow efficiently.

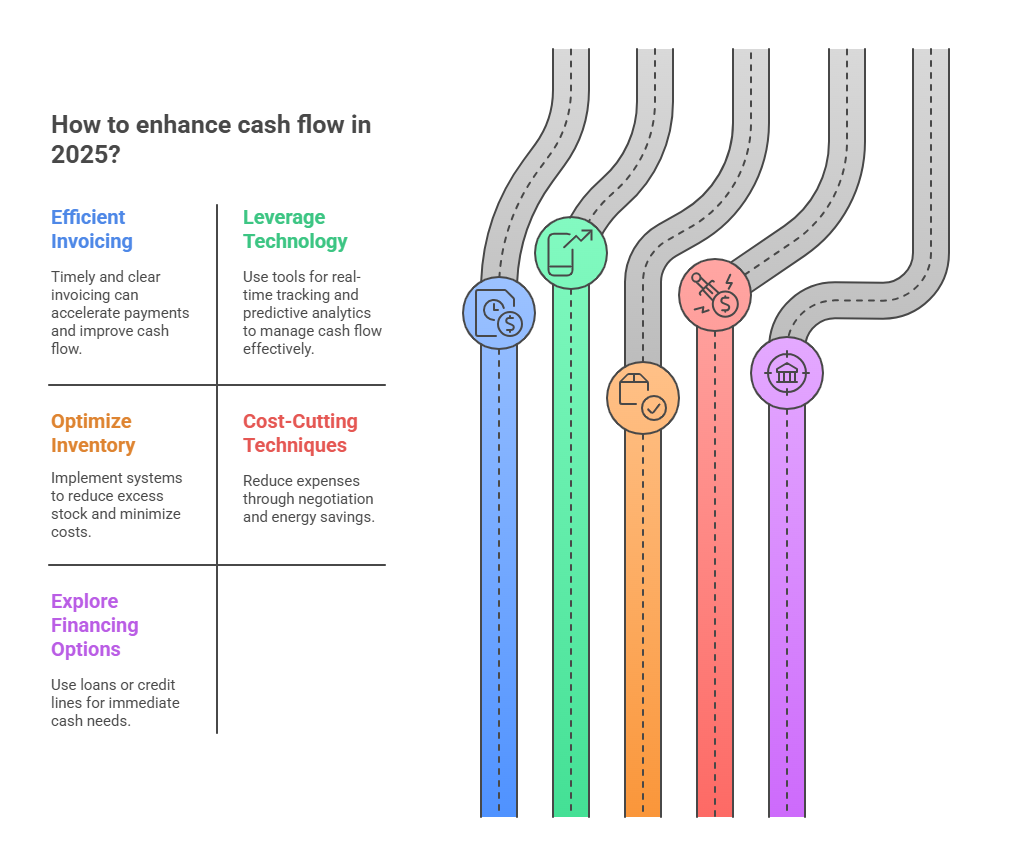

Key Strategies For Enhancing Cash Flow In 2025

Effective cash flow management is crucial for small business success. In 2025, businesses must adopt innovative strategies to ensure financial stability and growth. Below are key strategies to enhance cash flow:

Implementing Efficient Invoicing Practices

Streamlined invoicing is essential. Ensure invoices are clear and sent promptly. Here are some tips:

- Send invoices immediately after project completion.

- Use clear and simple terms.

- Offer multiple payment methods for convenience.

Consider using invoicing software to automate the process. This reduces errors and speeds up payment.

Leveraging Technology For Cash Flow Management

Technology can significantly improve cash flow management. Use tools like:

- Accounting software for real-time financial tracking.

- Mobile apps to monitor transactions anywhere.

- AI-powered analytics for predicting cash flow trends.

These tools provide insights that help in making informed financial decisions.

Optimizing Inventory Management

Excess inventory ties up cash. Optimize inventory by:

- Implementing just-in-time (JIT) inventory systems.

- Regularly reviewing inventory levels.

- Using inventory management software.

This ensures you only stock what is needed, freeing up cash for other uses.

Cost-cutting Techniques To Improve Cash Flow

Reducing expenses can significantly boost cash flow. Consider these techniques:

| Technique | Description |

|---|---|

| Negotiate with suppliers | Seek better payment terms or discounts. |

| Reduce utility costs | Implement energy-saving measures. |

| Outsource non-core activities | Focus on core business functions. |

Small changes can lead to significant savings over time.

Exploring Financing Options And Loans

Sometimes, external financing is necessary. Explore options like:

- Business loans for immediate cash needs.

- Lines of credit for flexible borrowing.

- Invoice factoring to convert unpaid invoices into cash.

Carefully evaluate each option to find the best fit for your business.

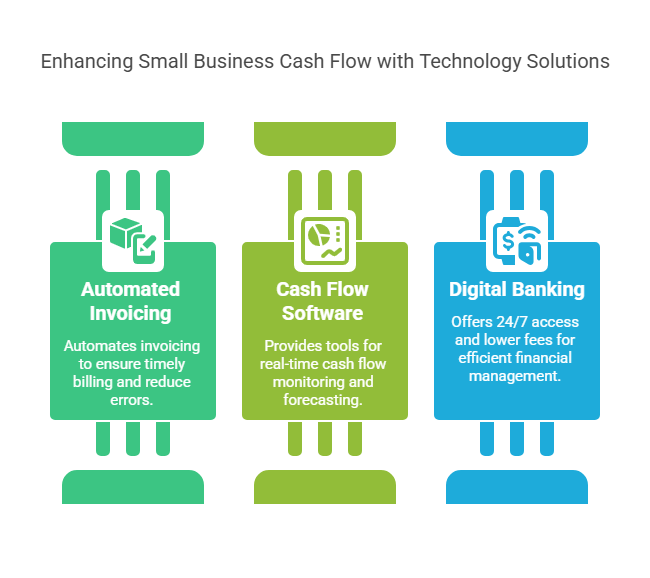

Utilizing Technology To Improve Cash Flow

In 2025, small businesses can greatly enhance their cash flow by leveraging technology. Utilizing modern tools can streamline financial processes, reduce errors, and ultimately improve profitability. Below, we explore three key areas where technology can make a significant impact.

Automated Invoicing And Payment Systems

Automated invoicing and payment systems can revolutionize the way small businesses manage their cash flow. By automating these processes, businesses can ensure timely invoicing and quick payments, reducing the risk of late payments and improving cash flow.

- Timely Invoicing: Automatically send invoices to clients as soon as services are delivered.

- Quick Payments: Enable customers to pay invoices online, reducing payment delays.

- Error Reduction: Minimize human errors in invoicing and payment processing.

Cash Flow Management Software And Tools

Cash flow management software provides small businesses with the tools they need to monitor and manage their finances effectively. These tools offer real-time insights into cash flow, helping businesses make informed decisions.

Some key features of cash flow management software include:

- Real-Time Monitoring: Track cash flow in real-time to identify potential issues early.

- Forecasting: Predict future cash flow based on historical data and trends.

- Budgeting: Set and manage budgets to ensure financial stability.

Benefits Of Digital Banking For Small Businesses

Digital banking offers numerous advantages for small businesses. It provides a convenient and efficient way to manage finances, reducing the need for physical banking.

Some benefits of digital banking include:

| Benefit | Description |

|---|---|

| 24/7 Access: | Access your accounts and perform transactions at any time. |

| Lower Fees: | Enjoy lower banking fees compared to traditional banks. |

| Enhanced Security: | Benefit from advanced security features to protect your finances. |

To explore a reliable digital banking option, consider NorthOne Business Banking. It offers a comprehensive suite of features designed to help small businesses manage their finances efficiently.

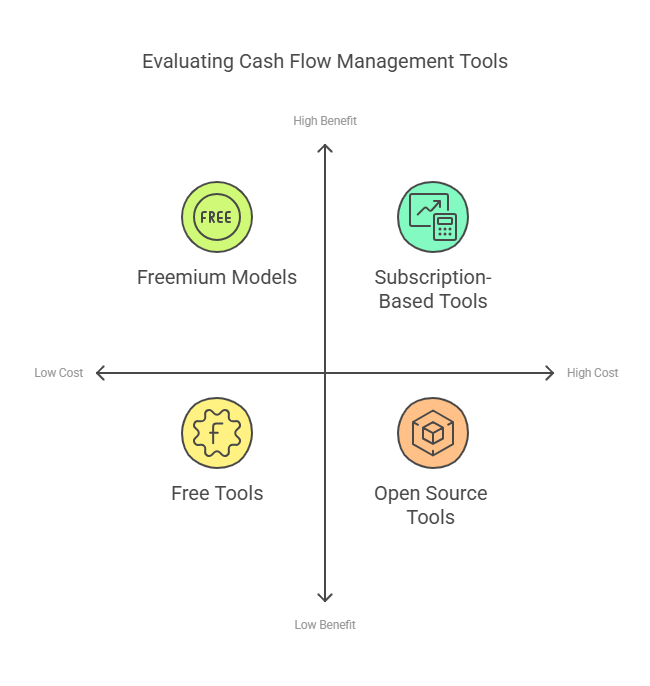

Pricing And Affordability Of Cash Flow Solutions

Enhancing cash flow is crucial for small businesses. Choosing the right tools helps manage finances effectively. Understanding pricing and affordability ensures optimal use of resources.

Cost-benefit Analysis Of Cash Flow Management Tools

Investing in cash flow management tools requires a thorough cost-benefit analysis. This analysis helps determine if the expense is justifiable. Consider the following factors:

| Factor | Details |

|---|---|

| Initial Cost | Upfront payment for acquiring the tool. |

| Subscription Fees | Monthly or yearly recurring charges. |

| Training Costs | Expenses for staff training to use the tool efficiently. |

| Maintenance | Ongoing support and updates for the tool. |

| Benefits | Improved cash flow, reduced financial stress, and better decision-making. |

Affordable Options For Small Businesses

Small businesses need affordable cash flow solutions. Here are some cost-effective options:

- Free Tools: Basic tools with essential features. Suitable for startups.

- Freemium Models: Free basic version with optional paid features.

- Subscription-Based Tools: Monthly or annual plans. Flexible and scalable.

- Open Source Tools: Community-developed tools with no licensing fees.

Return On Investment (roi) Of Implementing Cash Flow Strategies

Implementing cash flow strategies can yield significant ROI. Here’s how:

- Improved Cash Flow: Better cash management leads to more liquidity.

- Reduced Costs: Lower financial stress and fewer borrowing needs.

- Better Decision Making: Access to accurate data helps in making informed decisions.

- Increased Profitability: Efficient cash flow management boosts overall profitability.

Pros And Cons Of Different Cash Flow Strategies

Understanding the pros and cons of various cash flow strategies is vital. This knowledge can help small businesses in making informed decisions. Effective cash flow management can ensure business stability and growth.

Advantages Of Using Technology For Cash Flow Management

Using technology for managing cash flow offers many benefits. It simplifies complex processes and provides real-time insights.

- Automation: Reduces manual errors and saves time.

- Real-time tracking: Allows quick responses to financial changes.

- Data analysis: Helps in making better financial decisions.

Technological tools can also integrate with other business systems. This ensures a seamless flow of information across departments.

Potential Drawbacks And Risks

While technology offers many benefits, it also has potential risks.

- Cost: Implementing new systems can be expensive.

- Security: Digital systems are vulnerable to cyber-attacks.

- Training: Employees may need time to learn new tools.

Businesses must weigh these risks against the benefits. They should also invest in proper security measures to protect their data.

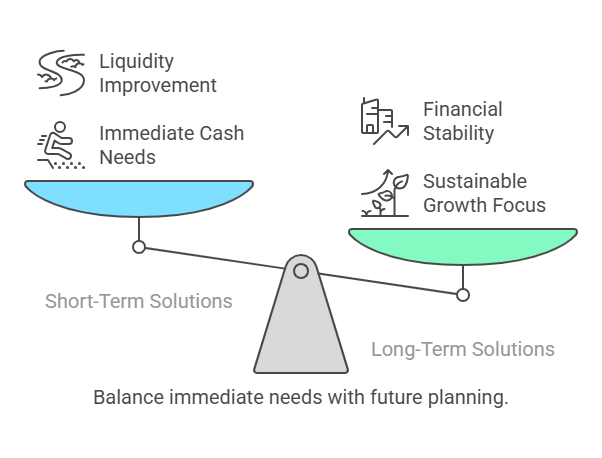

Balancing Short-term And Long-term Cash Flow Solutions

Balancing short-term and long-term cash flow solutions is crucial. Each has its own set of advantages and challenges.

| Short-Term Solutions | Long-Term Solutions |

|---|---|

| Quickly address immediate cash needs | Focus on sustainable growth |

| Improve liquidity | Build financial stability |

| Examples: short-term loans, invoice factoring | Examples: long-term investments, strategic planning |

Businesses need to find a balance between these strategies. This balance ensures they can handle immediate needs while planning for the future.

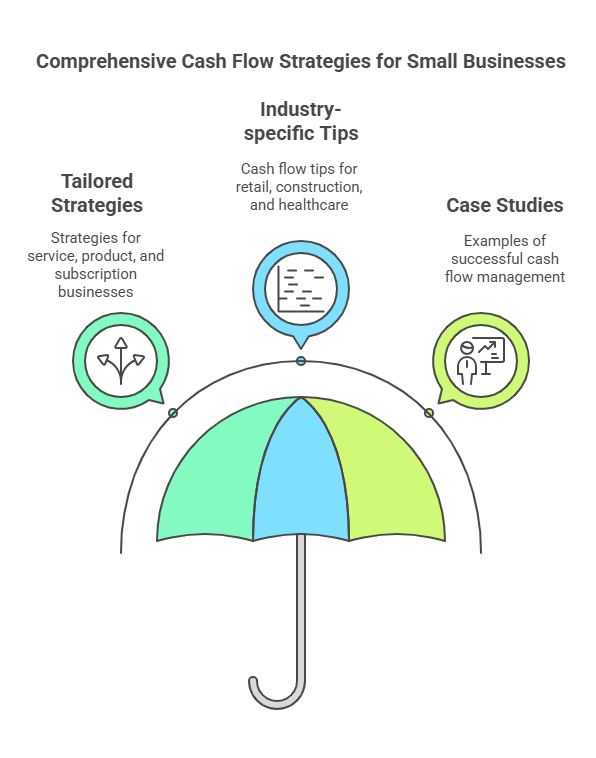

Specific Recommendations For Small Businesses

Enhancing cash flow is crucial for small businesses to thrive in 2025. Tailoring strategies to different business models and understanding industry-specific cash flow tips can make a significant difference. Learn from case studies of successful cash flow management to implement effective practices.

Tailoring Strategies To Different Business Models

Every business model has unique needs. Identifying these needs helps in crafting targeted cash flow strategies. Here are a few tailored recommendations:

- Service-based businesses: Focus on invoicing promptly and offering early payment discounts.

- Product-based businesses: Maintain optimal inventory levels to avoid overstocking or stockouts.

- Subscription-based businesses: Implement automated billing systems for timely payments.

Using these tailored strategies can address specific challenges and improve cash flow efficiency.

Industry-specific Cash Flow Tips

Each industry has unique cash flow dynamics. Here are some industry-specific tips:

| Industry | Cash Flow Tip |

|---|---|

| Retail | Offer seasonal promotions to boost sales during off-peak periods. |

| Construction | Negotiate payment terms with suppliers to align with project milestones. |

| Healthcare | Implement efficient billing systems to reduce delays in insurance claims. |

These tips help businesses manage their cash flow more effectively within their specific industry contexts.

Case Studies Of Successful Cash Flow Management

Learning from others can provide valuable insights. Here are some case studies:

- ABC Retail: Reduced inventory costs by 15% through better demand forecasting.

- XYZ Construction: Improved cash flow by negotiating longer payment terms with suppliers.

- HealthMed Clinic: Enhanced cash flow by automating the billing process, reducing delays.

These examples demonstrate effective cash flow management strategies that can be adapted to suit your business needs.

Conclusion: Future Trends In Cash Flow Management

The year 2025 promises significant advancements in cash flow management for small businesses. Staying ahead of these trends is crucial for maintaining a healthy cash flow. This section explores emerging technologies, economic changes, and sustainable practices for the future.

Emerging Technologies And Their Impact

Emerging technologies like AI and blockchain are transforming cash flow management. AI-powered tools provide real-time insights into cash flow patterns. Blockchain ensures secure and transparent transactions. Both technologies enhance decision-making and reduce errors.

Adopting these technologies can streamline invoicing and payments. Automated invoicing reduces the time spent on manual tasks. Blockchain-based smart contracts ensure timely payments. These advancements lead to improved cash flow stability.

| Technology | Impact |

|---|---|

| AI | Real-time insights, reduced errors |

| Blockchain | Secure transactions, timely payments |

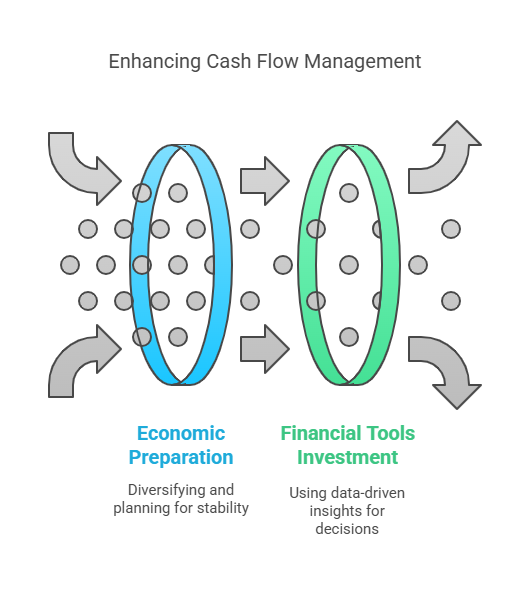

Preparing For Economic Changes

Economic changes can affect small business cash flow. Monitoring market trends helps in anticipating changes. Diversifying income sources can mitigate risks. Having a robust financial plan in place is essential.

Consider building a cash reserve. It provides a cushion during economic downturns. Regularly reviewing and adjusting budgets ensures financial stability. Staying informed about policy changes can help in adapting strategies.

- Monitor market trends

- Diversify income sources

- Build a cash reserve

- Review and adjust budgets

Final Thoughts On Sustaining Healthy Cash Flow In 2025

Healthy cash flow is vital for small business growth. Leveraging technology and staying prepared for economic changes are key. Invest in tools that provide cash flow insights. Maintain a flexible financial strategy.

Regularly track expenses and revenue. Use data-driven decisions to optimize cash flow. Engage with financial advisors for expert guidance. Fostering strong relationships with customers and suppliers ensures timely payments.

- Invest in cash flow tools

- Track expenses and revenue

- Make data-driven decisions

- Engage with financial advisors

Frequently Asked Questions

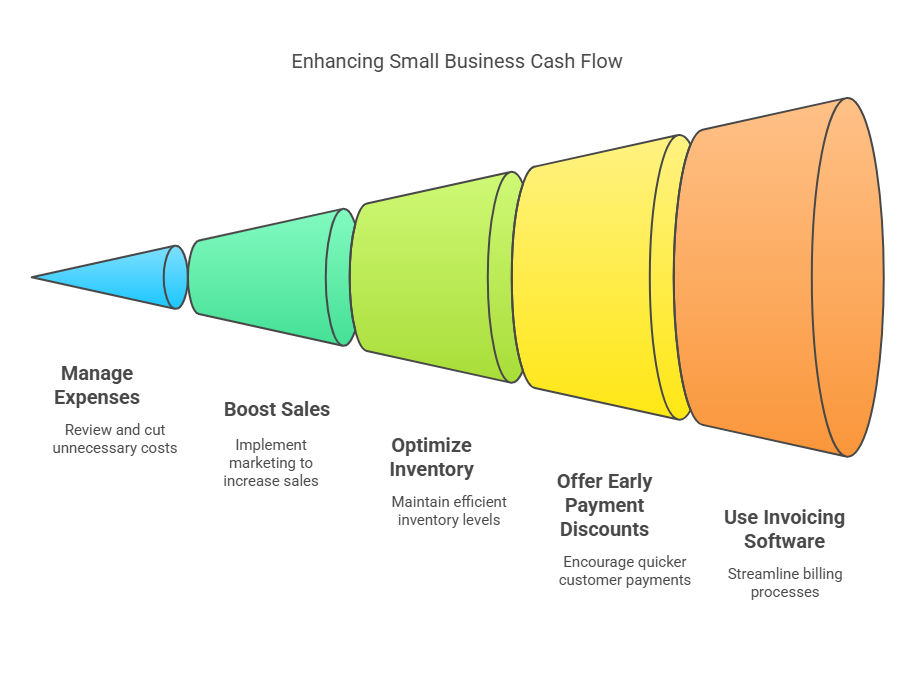

What Will Improve The Cash Flow Position For A Small Business?

Improve cash flow by managing expenses, boosting sales, optimizing inventory, and offering early payment discounts. Use invoicing software for quicker payments.

How To Do A Cash Flow Projection For A Small Business?

Create a cash flow projection by listing all expected revenues and expenses. Estimate monthly cash inflows and outflows. Track actual performance against projections regularly. Adjust projections as necessary to maintain accuracy. Use accounting software for ease.

Which Will Be The Fastest Way For A Business To Improve Its Cash Inflow?

Improve cash inflow by offering early payment discounts to customers. This encourages quicker payments and boosts cash flow.

How Much Cash Flow Is Good For A Small Business?

A good cash flow for a small business typically covers operating expenses, debt payments, and allows for growth. Aim for positive cash flow to ensure financial stability.

Conclusion

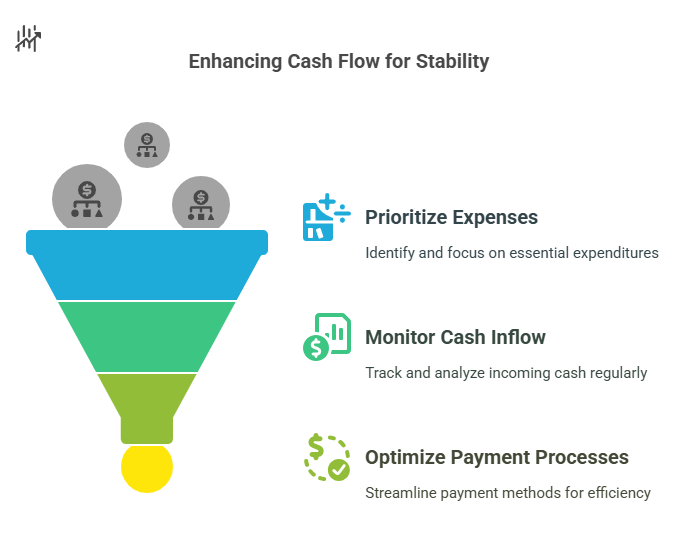

Improving cash flow is crucial for small businesses in 2025. NorthOne Business Banking offers a smart solution. Their app simplifies banking, ensuring smooth financial management. Use these strategies to enhance your cash flow. Prioritize expenses, monitor cash inflow, and optimize payment processes.

Stay proactive and adapt to changes. Better cash flow means more stability and growth. Visit NorthOne’s website for more details. Make informed decisions and secure your business’s future.

Thank you for taking the time to read my article “Enhance Small Businesses Cash Flow 2025: Proven Strategies”