Investing can be daunting, but Wealthify aims to simplify it. By using technology, Wealthify creates and manages tailored investment portfolios.

In our Wealthify Review 2025, we’ll explore how this platform has evolved and what it offers today. With a focus on ease of use, personalized plans, and ethical investments, Wealthify caters to both beginners and experienced investors. Whether you’re looking to save for retirement or invest in a tax-efficient manner, this review will provide insights into Wealthify’s services and help you decide if it’s the right choice for your financial goals.

Stay tuned as we delve into the features, benefits, and overall performance of Wealthify in 2025.

Credit: www.wealthify.com

Introduction To Wealthify

In 2025, Wealthify continues to be a top choice for online investment. This platform simplifies investing for beginners and experienced investors. Wealthify offers a range of products to suit various financial goals.

What Is Wealthify?

Wealthify is an online investment platform. It provides robo-advisory services using advanced algorithms. These services create and manage investment portfolios based on user preferences and financial goals.

The platform is designed to be user-friendly, offering a variety of investment plans. Users can choose from cautious to adventurous styles. Wealthify also offers ethical investment options.

Purpose And Vision Of Wealthify

Wealthify aims to make investing simple and accessible. The platform’s vision is to help individuals grow their wealth effortlessly. Wealthify focuses on low-cost investing with transparent pricing.

The main purpose of Wealthify is to provide a hassle-free investment experience. It caters to beginners and seasoned investors alike. Users can set financial goals, such as saving for a house or retirement. Wealthify then builds a portfolio to achieve these goals.

| Product Name | Wealthify |

|---|---|

| Description | Online platform offering investment ISAs, pensions, and savings accounts. |

| Main Features |

|

| Benefits |

|

For more details, visit their website.

Credit: everyinvestor.co.uk

Key Features Of Wealthify

Wealthify offers a range of features to make investing simple and accessible. Here, we explore its key features which set it apart from other platforms.

Automated Portfolio Management

Wealthify utilizes advanced algorithms and technology to manage your investments. This robo-advisory service tailors portfolios to your risk tolerance and financial goals. With automated management, you can enjoy hands-off investing and still grow your wealth effectively.

Diverse Investment Options

Wealthify provides various accounts to suit different needs:

- Stocks and Shares ISA: Invest tax-efficiently.

- Junior ISA: Save for your child’s future.

- Self-Invested Personal Pension (SIPP): Plan for retirement.

- General Investment Account: Flexibility without ISA restrictions.

- Instant Access Savings Account: Competitive interest rates with no upper limit.

Ethical Investment Choices

For those who want their investments to align with their values, Wealthify offers ethical investment options. These portfolios focus on socially responsible companies, ensuring that your investments contribute positively to society and the environment.

User-friendly Mobile App

The Wealthify mobile app is designed with ease of use in mind. It offers a simple and intuitive interface that makes managing your investments straightforward. Whether you want to check your balance, make adjustments, or track your progress, the app provides all the tools you need at your fingertips.

Customizable Risk Levels

Wealthify allows you to choose from various investment styles, ranging from cautious to adventurous. This flexibility ensures that your portfolio matches your risk appetite. You can start with a lower risk level and adjust it as you become more comfortable with investing.

Here’s a quick overview of the risk levels:

| Risk Level | Description |

|---|---|

| Cautious | Lower risk, lower potential returns |

| Tentative | Moderate risk, balanced returns |

| Confident | Higher risk, higher potential returns |

| Ambitious | Significant risk, significant returns |

| Adventurous | Highest risk, highest potential returns |

Pricing And Affordability

Wealthify aims to make investing accessible and affordable for everyone. Understanding their pricing structure is crucial for potential investors. This section will explore Wealthify’s fee structure, compare it with competitors, and evaluate its overall value for money.

Fee Structure Overview

Wealthify’s pricing is designed to be transparent and straightforward. Here are the key aspects of their fee structure:

- Platform Fee: Wealthify charges a platform fee of 0.60% per year on the value of your investments.

- Fund Charges: Additional fund charges range between 0.16% and 0.22% annually, depending on your chosen investment plan.

- No Hidden Fees: There are no fees for withdrawing your savings, making it easy to access your funds when needed.

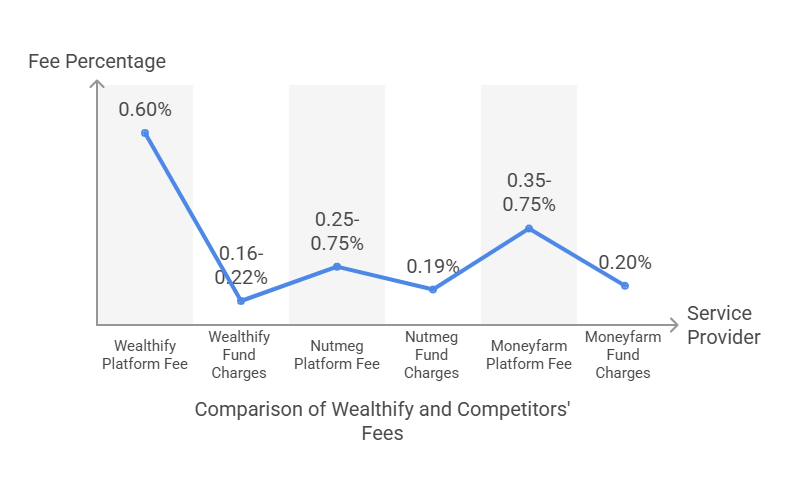

Comparative Analysis With Competitors

Let’s compare Wealthify’s pricing with other popular robo-advisory services:

| Provider | Platform Fee | Fund Charges |

|---|---|---|

| Wealthify | 0.60% per year | 0.16% – 0.22% per year |

| Nutmeg | 0.25% – 0.75% per year | 0.19% per year |

| Moneyfarm | 0.35% – 0.75% per year | 0.20% per year |

Value For Money

Wealthify offers a competitive fee structure, making it an attractive option for investors:

- Low Fees: Wealthify’s combined fees are generally lower than many competitors, ensuring more of your money is invested.

- Transparent Pricing: No hidden fees mean you know exactly what you’re paying for.

- Flexible Access: Withdraw your funds anytime without penalties.

Overall, Wealthify provides excellent value for money, especially for those new to investing or looking for a cost-effective investment platform.

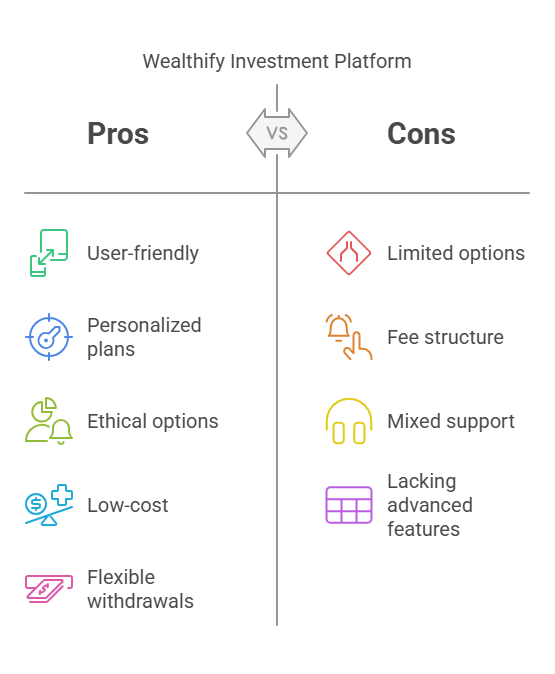

Pros And Cons Based On Real-world Usage

Wealthify has gained attention for its user-friendly approach to investing. But like any financial product, it has its strengths and weaknesses. Here, we’ll explore the pros and cons of Wealthify based on real-world usage.

Advantages Of Using Wealthify

Many users appreciate the ease of use of Wealthify’s platform. The app and website are designed to be intuitive, making it easy for beginners to navigate.

- Personalized Investment Plans: Wealthify offers plans tailored to different risk levels, from cautious to adventurous.

- Ethical Investment Options: Users can choose to invest in socially responsible companies.

- Low-Cost Investing: Wealthify emphasizes low fees and transparent pricing, making it accessible for all investors.

- Flexibility: Investors can withdraw funds at any time without penalty.

- Security: Backed by Aviva, Wealthify provides secure login details and has friendly customer support.

- Accessibility for Beginners: The platform is designed to simplify investing for those new to the market.

Drawbacks And Areas For Improvement

Despite its many advantages, there are some areas where Wealthify could improve.

- Limited Investment Options: While the platform offers various accounts, some users might find the range of investment choices limited.

- Fee Structure: Though Wealthify emphasizes low fees, there are still management fees for certain services that could be more transparent.

- Customer Support: Although generally positive, some users have reported mixed experiences with customer support.

- Advanced Features: More experienced investors might find the platform lacking in advanced features and tools.

Wealthify offers a balanced mix of benefits and areas for improvement. It’s essential to consider these factors when deciding if it’s the right platform for your investing needs.

Specific Recommendations

Choosing the right investment platform can be daunting, but Wealthify stands out for its simplicity and accessibility. Here, we provide specific recommendations on who might benefit most from using Wealthify and the best scenarios for leveraging its features.

Ideal Users For Wealthify

Wealthify is perfect for those new to investing. Its user-friendly interface and easy-to-understand tools make it ideal for beginners. The platform offers various investment plans tailored to different risk appetites, from cautious to adventurous.

- Beginners: Wealthify simplifies investing with its guided approach.

- Ethical Investors: Those who want their investments to reflect their social and environmental values.

- Individuals seeking low-cost options: Transparent pricing and low fees make it accessible.

Additionally, retirement planners can benefit from Wealthify’s pension plans, including Self-Invested Personal Pensions (SIPPs), which help users save for retirement efficiently.

Best Scenarios For Using Wealthify

Goal-based investing is one of Wealthify’s strong suits. Users can set specific financial goals, such as saving for a house, retirement, or a holiday, and Wealthify will help build a portfolio to achieve these goals.

- Saving for retirement: Utilize Wealthify’s pension plans to consolidate and grow your retirement funds.

- Investing tax-efficiently: Take advantage of Stocks and Shares ISAs to grow your investments without paying capital gains or income tax.

- General investment: For those who prefer non-tax-advantaged accounts, Wealthify offers General Investment Accounts with no restrictions.

Wealthify is also great for those who prefer hands-off investing. Its robo-advisory services manage and optimize your investment portfolios based on your risk tolerance and financial goals.

| Scenario | Recommended Feature |

|---|---|

| Beginners | Easy-to-use app and tools |

| Ethical Investing | Ethical investment options |

| Retirement Planning | Self-Invested Personal Pensions (SIPPs) |

| Tax-efficient Investing | Stocks and Shares ISAs |

| General Investment | General Investment Accounts |

With Wealthify, anyone can start investing with confidence, knowing their portfolios are managed by experts and aligned with their financial goals.

Credit: uk.pinterest.com

Frequently Asked Questions

Can Wealthify Be Trusted?

Yes, Wealthify can be trusted. It’s regulated by the Financial Conduct Authority (FCA). Customer reviews are generally positive.

What Is The Average Return On Wealthify?

The average return on Wealthify varies based on your chosen risk level. Generally, it ranges from 3% to 7% annually.

What Are The Risk Levels For Wealthify?

Wealthify offers five risk levels: Cautious, Tentative, Confident, Ambitious, and Adventurous. Each level balances potential returns and risk.

Which Is Better, Nutmeg Or Wealthify?

Nutmeg offers a wider range of investment options and personalized advice. Wealthify is more beginner-friendly with lower fees. Choose based on your needs.

Conclusion

Wealthify offers a user-friendly platform for all investors. It provides diverse investment options and ethical choices. Its low-cost structure and expert management make it appealing. Whether saving for retirement or other goals, Wealthify simplifies investing. Backed by Aviva, it ensures security and trust.

Visit Wealthify for more information.