Running a small business is tough, especially when handling invoices. A good invoicing tool can make this process faster and easier.

In 2025, the best invoicing software will not only save time but also help with payments. With so many options available, picking the right one is important.

Whether you’re a freelancer, developer, or business owner, the right tool can simplify your finances and improve customer experience.

This guide will cover the top invoicing software for small businesses in 2025 to help you choose the best one.

Introduction to Invoicing Software for Small Businesses

Managing invoices is important for small businesses. Invoicing software makes this task easier. It helps create, send, and track invoices quickly. The right tool saves time, reduces errors, and speeds up payments.

What Is Invoicing Software?

Invoicing software is a digital tool that helps businesses handle billing. It automates the invoicing process, making payments easier to manage. Most software includes features like invoice templates, payment tracking, and payment gateway integration.

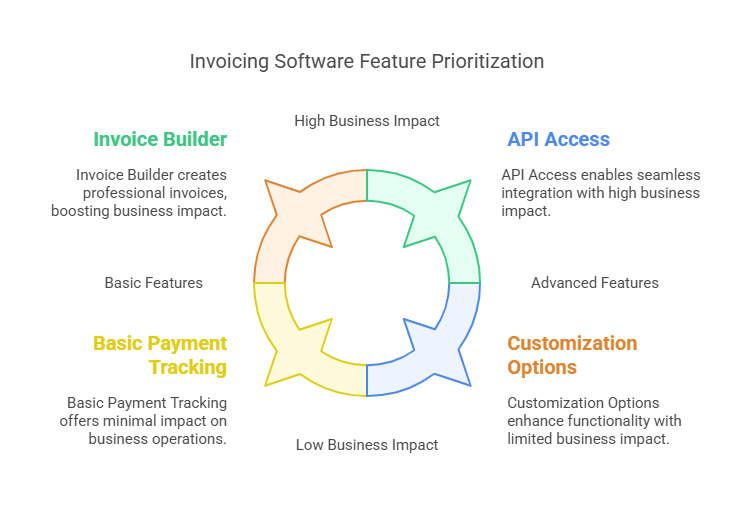

Key Features of Invoicing Software

| Feature | Description |

|---|---|

| Invoice Builder | Create professional invoices easily |

| Payment Gateways | Accept payments via Stripe, GoCardless, and PayPal |

| Management Tools | Track payments, expenses, and customers |

| API Access | Connect with other apps like Google Drive and Slack |

| Customization | White label options and custom SMTP |

| Mobile App | Use invoicing tools on iOS and Android |

Why Small Businesses Need Invoicing Software

Small businesses benefit in many ways from using invoicing software:

- Saves Time – Automates repetitive tasks and reduces manual work.

- Reduces Errors – Lowers mistakes in billing and payments.

- Improves Cash Flow – Sends reminders to ensure timely payments.

- Enhances Professionalism – Creates invoices that look professional.

- Better Tracking – Keeps income, expenses, and payments in one place.

- Increases Efficiency – Works with payment gateways for smoother transactions.

Why Choose Invoiless?

Invoiless is a great invoicing tool for small businesses, freelancers, and developers. It offers an easy-to-use invoice builder, online payments, and expense tracking.

With API access, businesses can connect Invoiless to other apps, making management easier. It also provides white label options, a mobile app, and automatic payments. This makes Invoiless a flexible and powerful choice for any small business.

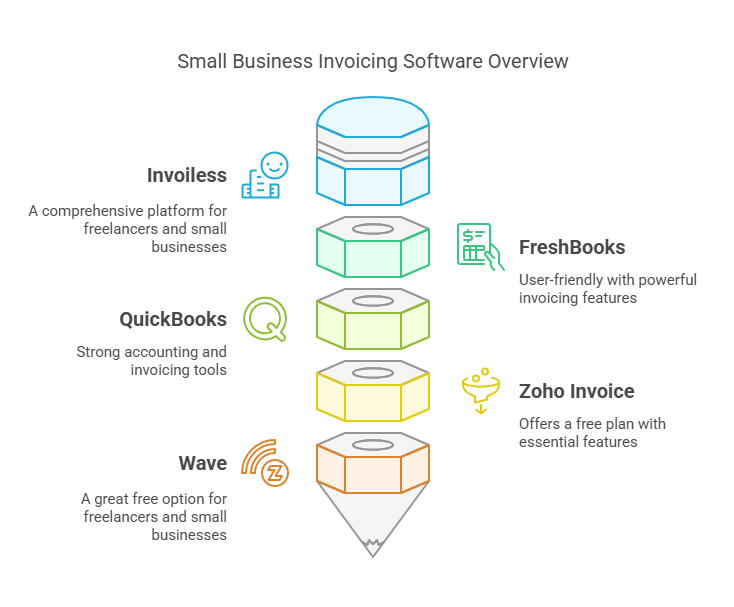

Top Invoicing Software for Small Businesses in 2025

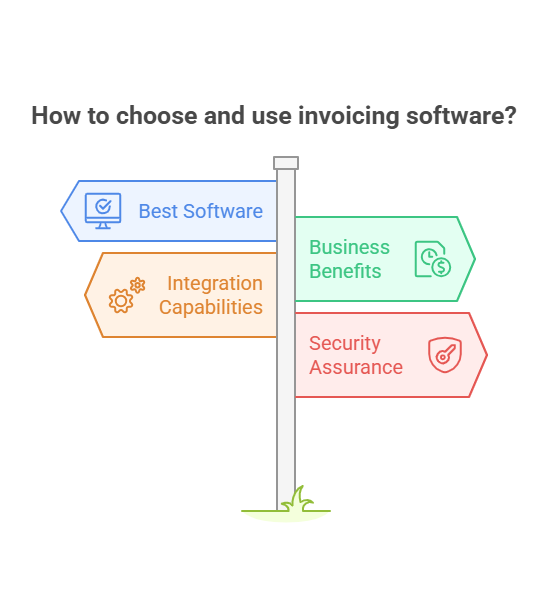

Choosing the right invoicing software is important for small businesses. It helps manage finances, saves time, and keeps transactions smooth. In 2025, several invoicing tools stand out. Below are some of the best options based on different needs and budgets.

Best Invoicing Software Picks

- Invoiless – A complete invoicing platform for freelancers, developers, and small businesses.

- FreshBooks – Easy to use with powerful invoicing features.

- QuickBooks – Offers strong accounting and invoicing tools.

- Zoho Invoice – A free plan with essential invoicing features.

- Wave – A great free option for freelancers and small businesses.

How We Chose These Tools

We selected these invoicing solutions based on key factors:

- Ease of Use – Simple setup and easy navigation.

- Features – Tools for creating, sending, and tracking invoices.

- Integrations – Works with apps like payment gateways and accounting tools.

- Pricing – Affordable plans, including free options.

- Customer Support – Reliable help through live chat, email, and guides.

A Closer Look at Invoiless

| Feature | Details |

|---|---|

| Invoice Builder | Create professional invoices easily |

| Payment Options | Accepts payments via Stripe, GoCardless, and PayPal |

| App Integrations | Connects with Google Drive, Slack, and more |

| Customization | White label options and custom SMTP |

| Automation | Supports recurring invoices and automatic payments |

| Mobile App | Available for iOS and Android |

| Pricing | Lifetime access for $69 |

Invoiless makes invoicing simple and efficient. It supports multiple businesses and can be customized to match your brand. With a one-time payment, you get lifetime access and all future updates.

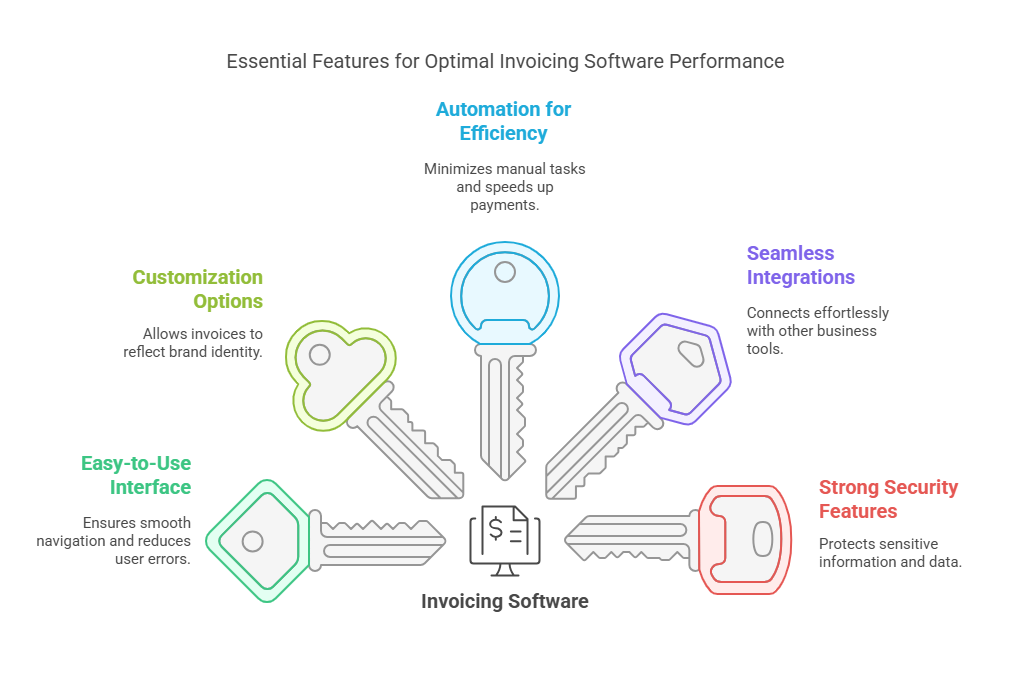

Key Features of the Best Invoicing Software

The best invoicing software in 2025 should make invoicing easier while improving efficiency. Here are the key features to look for when choosing the right tool.

1. Easy-to-Use Interface

A simple interface is important for smooth navigation. Users should be able to create, send, and track invoices without confusion.

Invoiless makes this process easy with its user-friendly invoice builder. Its clean design saves time and reduces mistakes.

2. Customization Options

Customization helps businesses match invoices to their brand.

With Invoiless, you can:

- Use a custom domain with SSL for security.

- Remove the Invoiless logo for a more professional look.

- Customize email notifications and manage payments with custom SMTP.

3. Automation for Efficiency

Automation reduces manual work and ensures payments arrive on time.

Invoiless offers:

- Recurring invoices for regular clients.

- Automatic payments to speed up transactions.

- Estimate generation to help plan future invoices.

- Expense tracking for better financial management.

4. Seamless Integrations

Good invoicing software should connect with other business tools.

Invoiless integrates with:

- Payment platforms like Stripe, GoCardless, and PayPal.

- Apps like Google Drive and Slack for better workflow.

- API access for custom connections with other software.

5. Strong Security Features

Security is essential when handling payments and customer data.

Invoiless provides:

- A custom domain with SSL for secure transactions.

- Data protection to keep customer details safe.

For more details, check out the official Invoiless product page.

Pricing and Affordability

Choosing the right invoicing software requires a balance between cost and features. Below, we break down pricing models, free vs. paid versions, and overall value.

Subscription Models

Most invoicing tools charge monthly or yearly fees. Invoiless, however, offers a lifetime deal with a one-time payment of $69 (originally $540). This means:

- No recurring fees – Pay once and use it forever.

- More savings – Avoid monthly or annual costs.

- Ideal for small businesses – A budget-friendly option for long-term use.

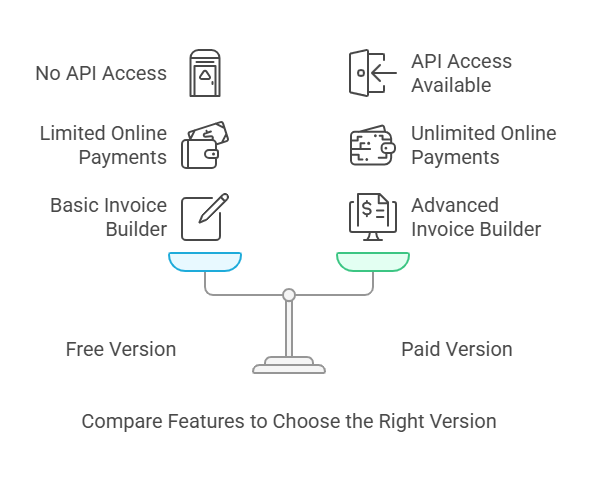

Free vs. Paid Versions

| Feature | Free Version | Paid Version |

|---|---|---|

| Invoice Builder | Basic | Advanced |

| Online Payments | Limited | Unlimited |

| API Access | No | Yes |

| Mobile App | Limited | Full Access |

| White Label Options | No | Yes |

The free version is great for startups or businesses with simple invoicing needs. The paid version unlocks full features like unlimited payments, API access, and branding customization.

Is It Worth the Price?

For $69, you get:

✔ Unlimited invoices, estimates, and customers

✔ Automation for recurring payments and expenses

✔ Custom branding to match your business

✔ Future updates at no extra cost

✔ 60-day money-back guarantee for risk-free investment

Pros and Cons of Top Invoicing Software in 2025

Choosing the right invoicing tool can boost your business’s efficiency and cash flow. Here, we look at the pros and cons of three popular invoicing solutions to help you decide.

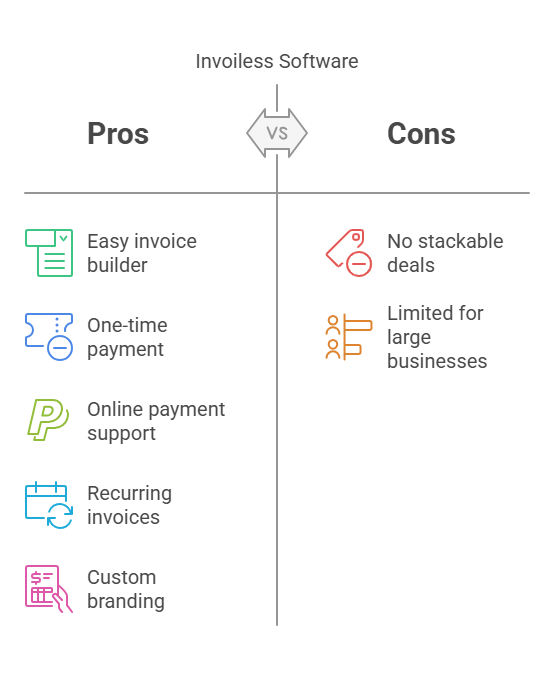

1. Invoiless

⭐ Best for: Freelancers, small businesses, and developers looking for a one-time payment solution.

✅ Pros:

✔ Easy-to-use invoice builder – Create professional invoices in minutes.

✔ One-time purchase ($69) – Lifetime access with no monthly fees.

✔ Accept online payments – Supports Stripe, GoCardless, and PayPal.

✔ Unlimited recurring invoices – Automate payments and save time.

✔ Custom branding – White label, custom domain, and SMTP.

✔ Mobile app – Manage invoices on iOS & Android.

✔ API & integrations – Works with Google Drive, Slack, and more.

❌ Cons:

✘ No stackable deals – Cannot combine multiple lifetime deals.

✘ Limited for large businesses – Best suited for freelancers and small teams.

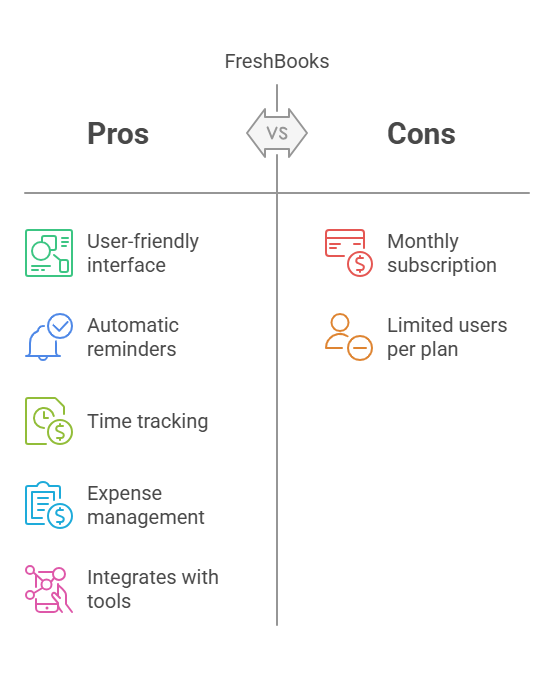

2. FreshBooks

⭐ Best for: Businesses needing accounting and invoicing in one platform.

✅ Pros:

✔ User-friendly interface – Great for non-accountants.

✔ Automatic late payment reminders – Helps improve cash flow.

✔ Time tracking & expense management – Useful for freelancers and service-based businesses.

✔ Integrates with many accounting tools – Works with QuickBooks, PayPal, Stripe, and more.

❌ Cons:

✘ Monthly subscription required – Starts at $19/month.

✘ Limited users per plan – Extra cost for additional team members.

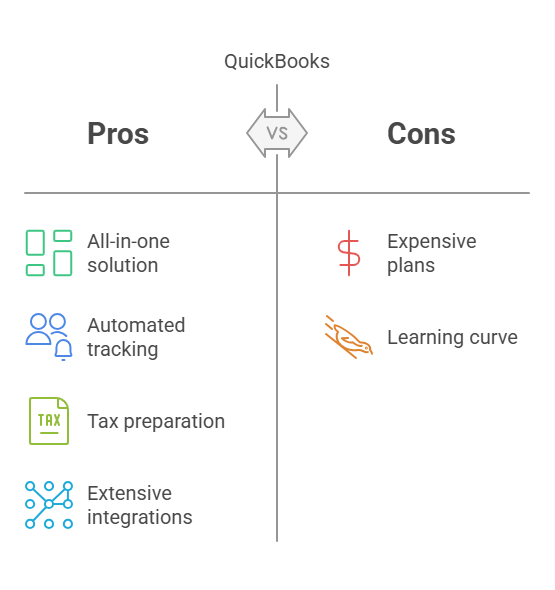

3. QuickBooks

⭐ Best for: Businesses needing full accounting + invoicing features.

✅ Pros:

✔ All-in-one financial management – Includes invoicing, accounting, and reporting.

✔ Automated invoice tracking & payments – Sends reminders for overdue payments.

✔ Works well with tax preparation – Helps manage financial reports.

✔ Integrates with hundreds of tools – Stripe, PayPal, Shopify, and more.

❌ Cons:

✘ Expensive plans – Starts at $30/month.

✘ Learning curve – Can be overwhelming for beginners.

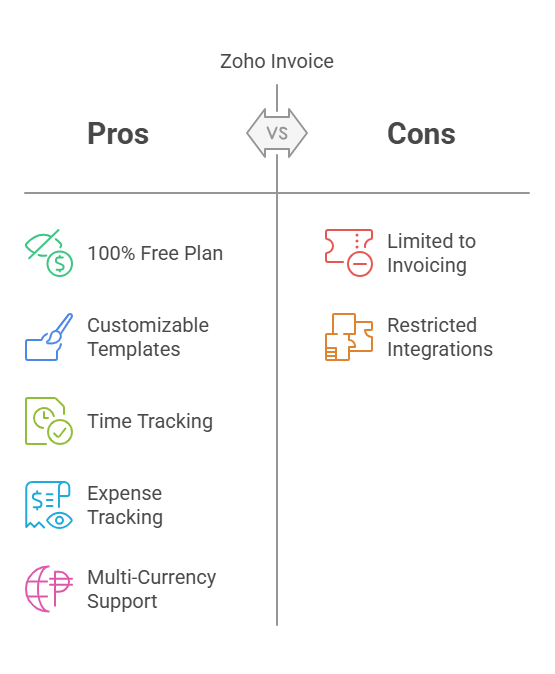

4. Zoho Invoice

⭐ Best for: Small businesses looking for a free invoicing solution.

✅ Pros:

✔ 100% free plan – Great for startups and freelancers.

✔ Customizable invoice templates – Adjust design and branding.

✔ Time tracking & expense tracking – Manage billable hours.

✔ Multi-currency & multilingual support – Ideal for international businesses.

❌ Cons:

✘ Limited to invoicing – No full accounting features.

✘ Restricted integrations – Fewer third-party apps compared to competitors.

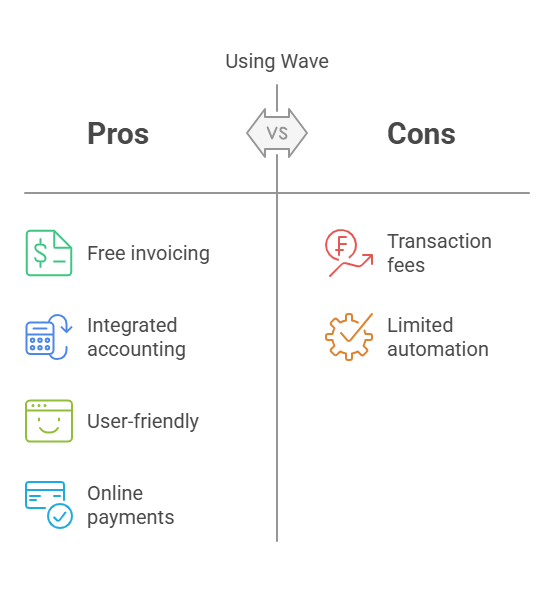

5. Wave

⭐ Best for: Freelancers & startups needing a free invoicing & accounting tool.

✅ Pros:

✔ Completely free invoicing – No hidden costs.

✔ Includes accounting & receipt scanning – Helps manage expenses.

✔ Easy-to-use interface – Ideal for beginners.

✔ Accepts online payments – Works with Stripe and bank transfers.

❌ Cons:

✘ Higher transaction fees – Online payments incur additional costs.

✘ Limited automation – No advanced features like recurring invoices.

Which One Should You Choose?

- Best for Freelancers & Small Businesses: Invoiless (Lifetime deal, easy to use)

- Best for Accounting & Invoicing: QuickBooks

- Best for Free Invoicing: Zoho Invoice or Wave

- Best for Business Growth: FreshBooks

Want an affordable one-time payment solution? → Try Invoiless!

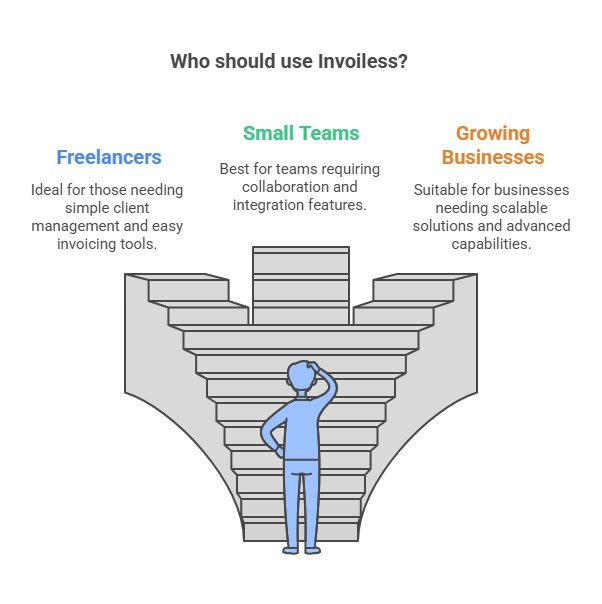

Who Should Use These Tools?

Best for Freelancers

Freelancers need simple tools that manage clients easily. Invoiless offers:

- Easy-to-use invoice builder

- Online payments through Stripe, GoCardless, and PayPal

- Income and expenses tracking

- Unlimited recurring invoices

Best for Small Teams

Small teams need tools that support teamwork. Invoiless provides:

- Unlimited team members

- API access and integrations (Google Drive, Slack)

- Customizable to match your brand

- Customer portal for easy client access

Best for Growing Businesses

Growing businesses need scalable and advanced features. Invoiless delivers:

- Automatic payments

- White label options (custom domains, no Invoiless branding)

- Detailed report generation

- Manage multiple businesses

For more details, check out the Invoiless website.

Frequently Asked Questions (FAQs)

What is the best invoicing software in 2025?

The best invoicing software in 2025 offers powerful features, an easy-to-use interface, and seamless integrations. Some top choices include QuickBooks, FreshBooks, and Zoho Invoice.

How does invoicing software help small businesses?

Invoicing software automates billing, tracks payments, and manages customer details. It helps save time, reduces errors, and improves cash flow by ensuring faster payments.

Can invoicing software integrate with accounting tools?

Yes! Most invoicing tools sync with popular accounting software, helping you manage finances smoothly and keep records accurate.

Is cloud-based invoicing software secure?

Yes, most cloud-based invoicing tools are secure. Providers use encryption and strong security measures to protect sensitive data from threats.

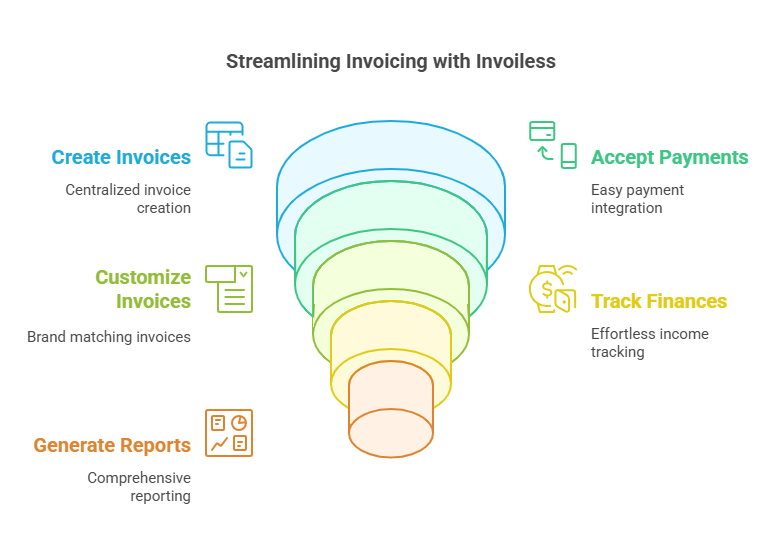

Conclusion

Picking the right invoicing software can make a huge difference for your small business. Invoiless is a complete solution that makes invoicing simple and hassle-free.

With Invoiless, you can:

✔ Create and manage invoices in one place

✔ Accept payments easily through Stripe, PayPal, and more

✔ Customize invoices to match your brand

✔ Track income, expenses, and generate reports effortlessly

✔ Save money with a one-time payment for lifetime access

For small businesses and freelancers, this is a smart investment that saves time and boosts efficiency.

👉 Ready to simplify your invoicing? Visit the Invoiless website and take control of your finances today!

Thank you for taking the time to read my article “Best Invoicing Software for Small Businesses in 2025: Top Picks”